By Brendan Boyle, Director, Market Intelligence, Transparent Energy, March 2025

As we noted in our most recent market report, the natural gas market is experiencing a fundamental shift. Prompt month prices increased on 15 consecutive trading days from January 31st through February 21st amid the coldest Jan-Feb the U.S. has experienced over the past 10 years. Most of the gains have been focused on the front end of the curve. While the 12-month natural gas price strip has increased 19% in February, there has been little movement in the forward calendar strips from 2027-2030. This presents a unique opportunity for energy buyers looking to secure long-term budget certainty. The graphic below shows the change in NYMEX natural gas prices by year over the last month:

| Date | Bal 2025 | Cal 2026 | Cal 2027 | Cal 2028 | Cal 2029 | Cal 2030 |

| Jan 31st | $ 3.54 | $ 3.87 | $ 3.75 | $ 3.62 | $ 3.51 | $ 3.40 |

| Feb 25th | $ 4.29 | $ 4.18 | $ 3.75 | $ 3.58 | $ 3.47 | $ 3.30 |

| % ∆ | +21% | +8% | 0% | -1% | -1% | -3% |

What are the Major Energy Companies Saying?

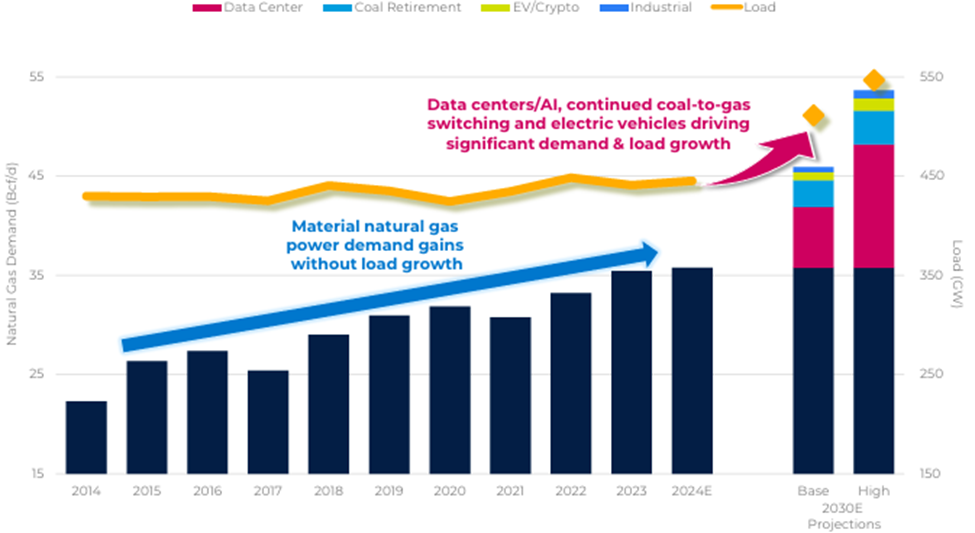

Recent reports from several energy companies suggest that this opportunity to capitalize on relatively inexpensive long-term energy purchases may be short lived. In its latest earnings report, natural gas producer EQT forecasts substantial growth for natural gas demand from the electric generation sector:

Source: EQT Fourth Quarter 2024 Investor Presentation

Over the past 10 years, U.S. natural gas-fired electricity demand grew by 14 Bcf per day despite minimal underlying load growth. This expansion was led by coal plant retirements and coal-to-gas switching. The U.S. Energy Information Administration (EIA) suggests that electricity generators plan to retire 8.1 gigawatts (GW) of electric capacity in 2025, which represents a 100% increase compared with 2024 retirements. Over the next 5 years, it is expected that gas burn will only accelerate due to the emergence of new data centers, electric vehicles, and cryptocurrency mining.

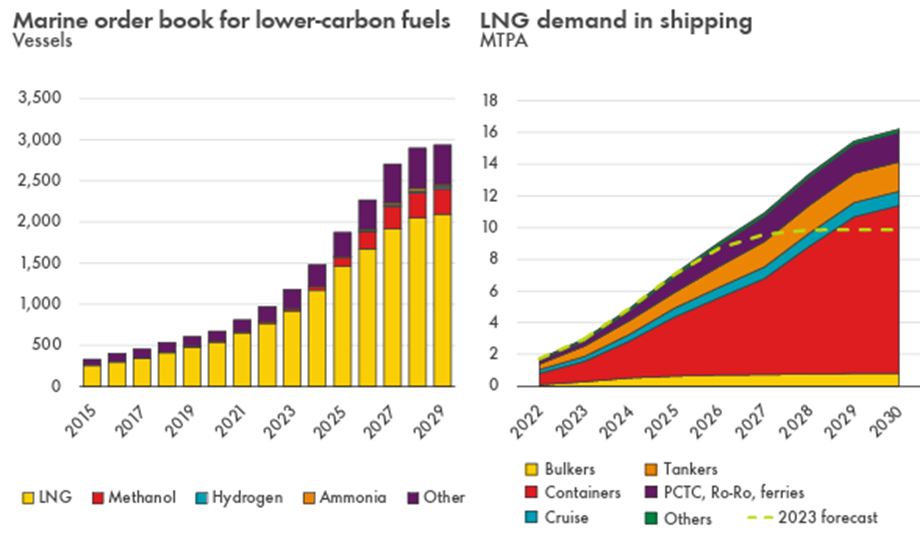

Another major factor to consider is the growth of liquified natural gas (LNG) exports from the U.S. to foreign markets. Oil major Shell recently released its 2025 outlook for LNG, highlighting their belief that expansion in the industry is inevitable, saying that “LNG enables lower emissions in hard-to-electrify sectors and paves the way for net-zero emissions.” Global LNG trade exceeded 400 million tons in 2024, but total growth over the past year was only 3 million tons. Shell expects that by 2030, the market will have increased by an additional 150 million tons as Asian and European markets look to decarbonize heavy industry and help support emerging electricity demand. The data below shows us an upward trajectory in global LNG demand:

Source: Shell LNG Outlook 2025

What Else has Changed?

As we’ve noted in the past, there is a strong negative correlation between natural gas inventory levels and the price of gas. Higher demand and increased exports mean less gas available in U.S. storage facilities. There is an expectation that American companies will face fewer restrictions and greater incentives to produce more natural gas to help offset the upcoming shortfall, however, market characteristics have changed over the past decade. The period from 2014-2019 was characterized by stability, underpinned by ample capital, infrastructure growth, and rapid acceleration in production. Since 2020, we’ve seen a decline in drilling activity and much stronger producer discipline. According to data from Baker Hughes, natural gas-directed drilling rigs have fallen from 166 in September 2022 to 99 currently. Producers have made it clear that they will not spend to increase production unless they are able to secure higher prices.

One last point to consider is the proposed tariffs, particularly as they relate to China and Canada, two of our largest trading partners. The Chinese tariffs are likely to have an impact on the renewable energy market as China is a major supplier of grid converters and lithium-ion batteries. As recently as this past summer, we witnessed how valuable renewable resources can be during periods of high electric demand.

A recent plan was suggested to impose a 10% tax on energy imports from Canada. During the most recent cold-weather blast, the U.S. was importing more than 10 Bcf per day of natural gas from Canada. That represented ~7% of total U.S. gas demand on those days. An increase in the cost of Canadian natural gas would certainly have an impact on the cost paid by end users, especially when the weather turns cold.

To Summarize:

- 1. Demand for natural gas is increasing, particularly in the power generation sector.

- 2. LNG exports are primed to grow rapidly as at least 10 new U.S. export terminals are expected to come online by 2030.

- 3. Natural gas companies are not willing to increase production at current price levels.

- 4. Upcoming tariffs provide further uncertainty for future energy prices.

- 5. Medium to long term energy prices are still favorable, but for how long?

What Does This Mean for Your Business?

As we have been suggesting for the past year, NOW is the time to act and secure budgetary certainty as it relates to energy costs. Customers that missed the opportunity to hedge a position ahead of this winter will likely regret the decision as their winter bills come due. Fortunately, there is still an opportunity to secure low-cost electricity and natural gas for the rest of the decade.

That said, one common concern for energy buyers is “what if prices come down?” An option we favor in order to take advantage of such an eventuality is to secure a partial hedge for future years. Even when entering a long-term agreement, flexibility is still an option. Transparent Energy has helped clients from various industries hedge percentages ranging from 10% to 75% of expected energy consumption for the years 2026 through 2031. This dollar-cost averaging approach provides partial cost protection by enabling you to improve your rate if the market drops, or put in a stop loss if prices continue to move higher.

Hedging strategy and execution require expertise. For those who have that in-house, Transparent Energy can supplement the good work of your team, and be your expert procurement arm. For those who don’t, now is a great time to become a Transparent Energy customer.

Either way, don’t miss the opportunity we’ve outlined here, as it could be gone soon, and we don’t know when we’ll see long-term prices this attractive again. Contact your Transparent Energy advisor today to find out the best options available for your business.

###

Interested in staying on top of energy market developments? Contact us via our web form or at LetsTalk@TransparentEdge.com to put it all in context for your business.