In what has come to be known as “The Godzilla article” (published this September), we warned of an impending spike in natural gas prices (an important proxy for electricity prices) and a narrowing window of opportunity for organizations to procure energy at an attractive rate.

If you read no further, please know the opportunity to secure energy for your business at a favorable rate – i.e., before a dramatic rise in electricity prices – is still available, but barely. If the call to action of the Godzilla article was “go low and go long,” the theme of this one, Godzilla II, is “go now and go long.”

There is no more time to wait. Let me explain.

Recent Record Low Natural Gas Prices

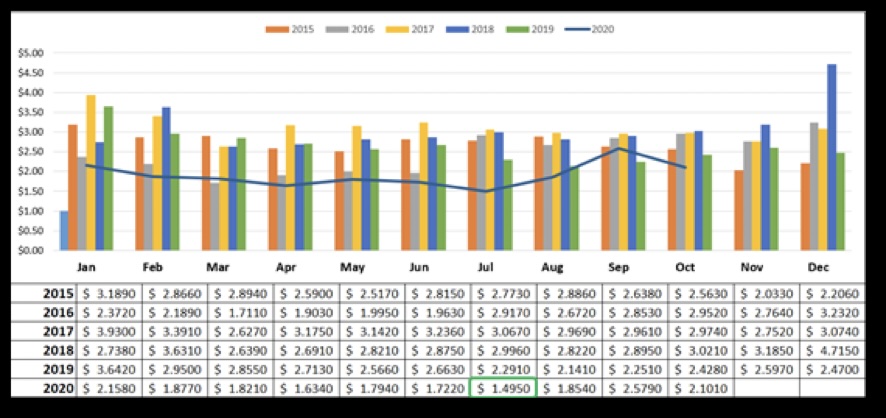

We warned of the waning days of low natural gas prices and an impending reversal of price momentum. Indeed, record-low natural gas prices throughout April-August of 2020 presented ample opportunities to “go low and go long” and reflected a perfect storm of bearish headwinds for the volatile energy commodity. First, an explosion of record-setting natural gas production in 2018-19, followed by consecutive anomalous winters, leading to bloated storage levels ahead of the global COVID-19 pandemic, which in turn, further decimated domestic demand throughout 2020 and drove prices even lower.

That’s a mouthful, I know. But the message at the time was simple: “we are in a buyer’s market the likes of which we have never seen before in the history of deregulated energy and which may never be seen again in our lifetimes.”

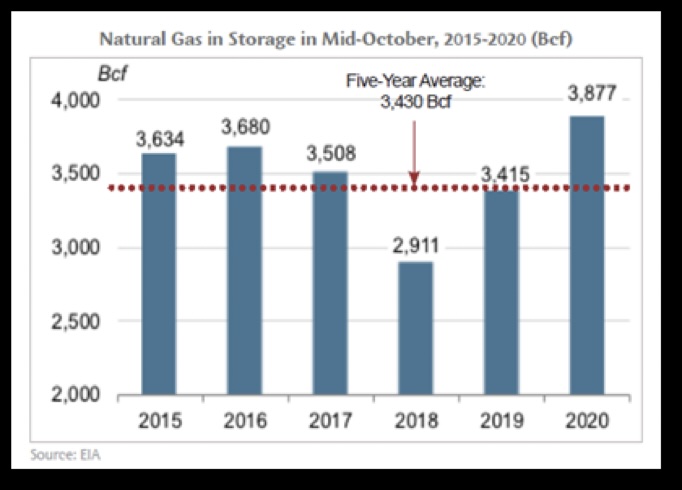

And the messaging proved correct. In fact, at the end of June 2020, the market bottomed out at $1.495/MMBtu ahead of the July-2020 contract expiration, the lowest price in 20 years. We mentioned bloated storage levels earlier, and it is a topic worth revisiting now for a couple of reasons. Firstly, because while storage levels technically are still “bloated” (we are nearing 4,000 Bcf in working storage, a level eclipsed only twice before), natural gas futures contracts for all of 2021 have risen 18% since June, seemingly in the face of logic, as elevated storage levels will typically weigh on prices, not propel them.

A Balloon Ready to Pop!

The reality is that while we do have ample gas in storage to carry through winter and into 2021, storage is bloated more like a balloon ready-to-pop than a heavy belly after Thanksgiving dinner. And it is the recoil from that pending pop that end-users need to watch out for.

Secondly, when discussing storage levels, it is easy to fixate on the total volume in underground storage and overlook the weekly historical perspectives. Here’s the most telling perspective: in March of 2020, “bloated” meant a 79% increase in working volumes when compared to the same week in the previous year; today, “bloated” means a measly 7% increase when compared to the same week in the previous year.

So, with a global pandemic drastically reducing commercial and industrial demand, why would we see 31 consecutive decreases in this historical perspective, and lose 70% of the storage surplus?

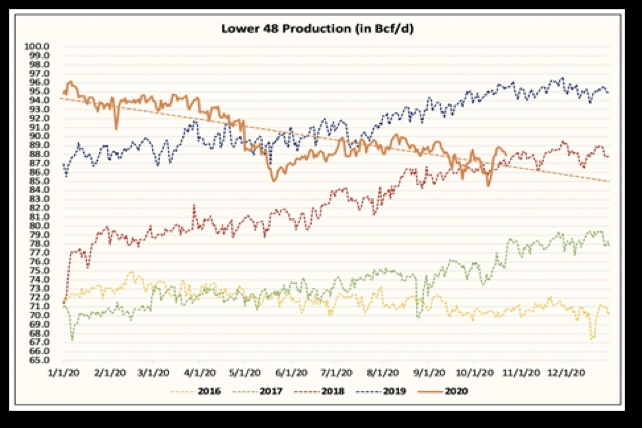

The answer is twofold: 1) our “free” associated gas production (a byproduct of crude oil production) has fallen victim to oil prices still struggling since the April collapse, and 2) natural gas producers have reduced spending (i.e. producing) by about 50%, resulting in historically low rig counts. When it comes to commodities, for every winner (in this case, end-users/energy consumers), there is a loser (producers), and we have since witnessed several E&P companies with strained balance sheets significantly reduce capital expenditures in an effort to weather the storm, while an astounding 13 different E&P companies filed for bankruptcy in July-August alone (with more likely to follow suit by year’s end).

Correspondingly, daily natural gas production has swiftly and steadily declined throughout the summer months and continues to do so heading into the fall and winter. At the same time, with the exception of some tropical storm-related shut-ins, LNG exports have been steadily increasing since July. This makes perfect sense when considered from the remaining producers’ economic perspective: $6.50/MMBtu JKM (North Asia) prices compared to sub-$2/MMBtu Henry Hub (domestic price) yield a greater return.

With forecasts for a cold winter approaching, LNG cargoes continue to embark for Asia at an increasing rate, where JKM prices have reached a one-year high ($6.668/MMBtu) as recently as last week. As reported by NGI, “demand for U.S. LNG is forecast to be ‘durable’ through the winter and into next summer, with exports reaching 10.3 Bcf/d, or 95% utilization, from December to February.”

LNG is a thief at the doorstep, the one who knocks, every night.

The only thing that would slow down this level of exports, or revitalize investment and production, would be competing and rising domestic prices. Interestingly, that is exactly what Wall Street is betting on, and both Morgan Stanley and Raymond James have speculated that could be a very real scenario in the undersupplied market of 2021.

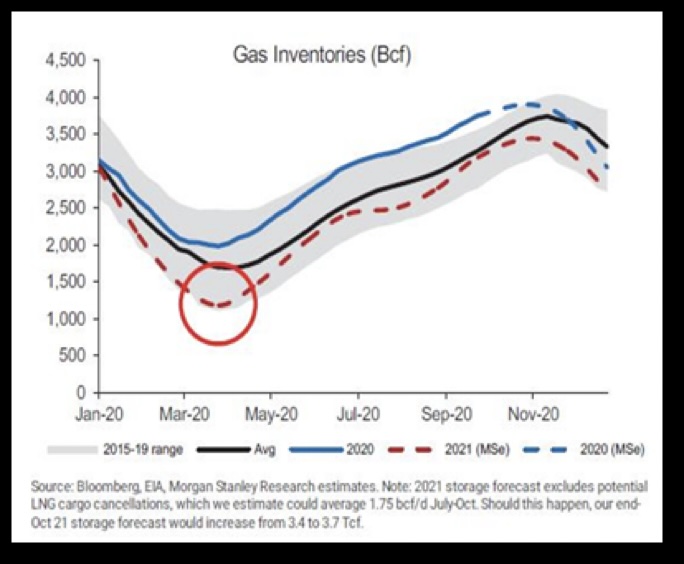

Remember the bloated storage balloon? Well, it should pop this winter, and the surplus will flip to a deficit. Recoil. Whiplash. Bear becomes bull. $2/MMBtu gas (2020) becomes $4/MMBtu gas (2021). Here is how Morgan Stanley has modeled inventories and market balance following the upcoming winter season:

“The combination of falling supply and rebounding demand leads to tight inventories. After ending October 2020 at 3.9 tcf, roughly in line with the 5-year normal, Morgan Stanley expects the combination of constrained supply and increasing demand to lead to one of the largest winter draws over the past decade. Assuming normal 10-year weather, Morgan Stanley expects tight end-March inventories of 1.2 tcf (35% below the 5-year normal of 1.8 tcf), with a mounting deficit thereafter. Colder than normal weather could lead to the lowest US gas inventory levels on record, and a material price rally to $5/MMbtu, or higher, and average in the mid-$4 range for full-year 2021.”

If that doesn’t get the juices flowing, I don’t know what will.

A New Bull Market in Natural Gas (and What You Can Do to Protect Yourself)

Natural gas is a volatile commodity not only in that it is combustible. It is prone to extreme price volatility and sustained momentum; it works to achieve homeostasis, and to restore balance. We are coming out of an extended bear market (again, good for energy buyers and consumers, not so for producers) and are on the precipice of a new bull market (not shares of your favorite stock going up, but rather the price of energy to fuel your business).

Surely, if this is news to you, it might not be the best news you have received all day, so let’s follow it up with some good news. There is some merit in the conventional energy procurement maxim to “buy in the shoulder-months,” when demand is low and prices tend to follow. We are still within the fall shoulder-months.

If 2020 has felt reminiscent of the film Groundhog Day, please know that you’re not alone – excluding January and February, 2020 as a whole could really be viewed as one long shoulder month; demand levels and prices have certainly mimicked historical shoulder-month data throughout the year.

The next 4-6 weeks will likely be the final “lull” in the natural gas market for the foreseeable future, and we may not have traditional shoulder-month prices next year to count on; the springtime market will almost certainly be more raucous than its past blooms. Raymond James expects 2021 Henry Hub prices to average $3.50/MMBtu and approach $4.00/MMBtu before the year ends, suggesting the underlying bullish fundamentals will not be deterred by cyclical lulls next year.

That said, there are still opportunities for you in this market, right now. This year we are still looking at some potentially undervalued future contracts in light of these projections – consider the 2021 calendar year strip, for example. Presently trading around $3.05/MMBtu, that particular package represents a ~25% discount when compared to Morgan Stanley’s conservative estimate of $4/MMBtu for 2021.

There is still ample opportunity ahead for end-users to consider taking risk off the table ahead of 2021. Natural gas prices for Cal 2022 will most likely follow suit over the next 6-12 months, so even those end-users with future-dated contract expirations should consider reviewing their obligations. As I said in my introduction, “Go low and go long” has become “go now and go long.”

And while the majority of this discussion has centered around natural gas fundamentals, it can largely be extended to electricity prices. Generally speaking, a $0.50-$1.00/MMBtu increase in natural gas prices would result in a $3-$7/MWh increase in electricity futures in most areas of the country. The overall trajectory of wholesale electricity prices is likely to be a bullish one, and potentially exacerbated by the outcome of the election and any subsequent adjustments to state and federal energy policy initiatives.

Given the looming threat of electricity prices going through the roof, let me leave you with a few tips:

- Don’t wait for your current energy contract to near completion before seeking a new one. Businesses with 18 months or less remaining on their current contract can benefit from entering a new agreement now.

- “Go long.” If you can successfully lock in a favorable rate now, consider extending it beyond the industry average term of 24-36 months. Many buyers today are entering 36, 48 and even 60 month contracts to minimize their risk and maximize their gains.

- Always make suppliers compete for your business, even if your current supplier offers you a good rate. Experience has shown that a competitive process typically results in a much lower electricity rate than one offered independently by an incumbent supplier.

- Make sure your competitive process attracts multiple suppliers. For example, in 2020 the average Transparent Energy online auction attracts over 10 suppliers.

- Understand the solvency of suppliers. While record-low energy prices have helped energy buyers, they have hurt many in the supply industry. In addition, the supply market is in the midst of contraction and consolidation.

By acting now, you may remember late 2020 as the time you saved your company from the ravages of high energy prices well into the future. Take that, Godzilla!

For help evaluating your current energy contract and opportunity for long-term savings, please contact info@transparentedge.com.