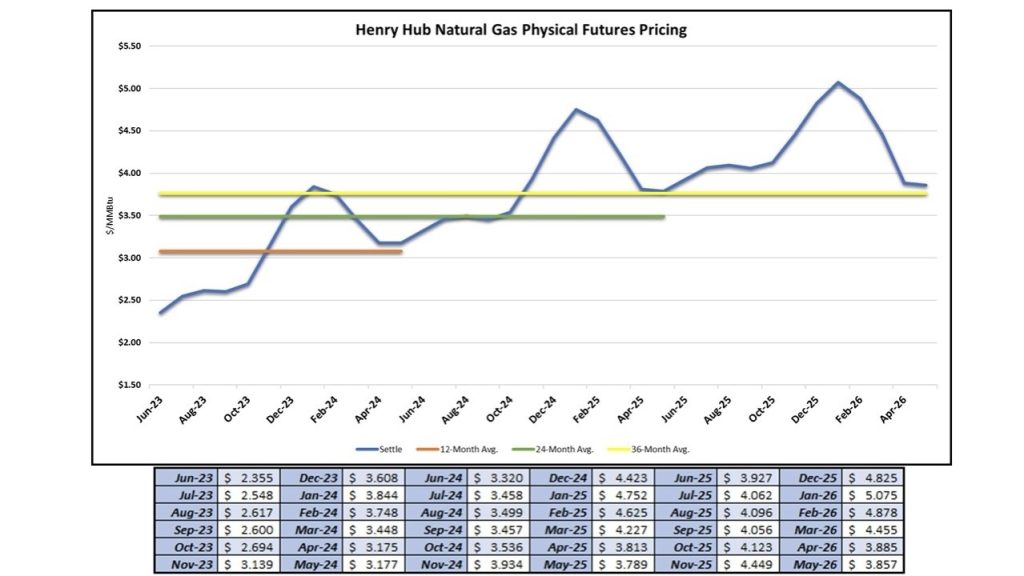

In the blink of an eye, summer will be here. And, if the Energy Information Administration is right, so will higher energy prices. It is predicting a Q3 natural-gas price increase that will put the commodity back above $3.00/Dth.

For those of you with good memories, I just wrote about the prospect of a summer price surge in my article, “Consider Buying Now: You Won’t Get Hurt Falling out the Basement Window!” In that piece, and in a subsequent webinar presented by Transparent Energy, we explored the factors driving natural gas prices down, and with them electricity prices, and why today’s prices in the two-dollar range are an amazing buying opportunity for your business.

I don’t want to rehash my past article here, but I do encourage you to read it. In the meantime, know this: you don’t have to take my word for it. Listen to the EIA. Market dynamics are pointing up this summer, so if you have an energy contract expiring any time in the next 12-18 months, jump on today’s lows and lock in a rate that is going to look very attractive for a very long time.

What If ?

Wait, you say, what if prices don’t shoot back up the way the EIA predicts, or what if they do but fall again? Put simply, today’s prices are extremely attractive by any historical measure, but there’s something else you need to know: over the last year energy markets have rediscovered volatility. It doesn’t take much to make the market jump, and if it gets hot this summer, the way it usually does, cooling demand will jump with it, and so will prices.

The other dynamic at play is one I have discussed many times now. Natural gas prices can only go so low. Yes, storage levels are high, and demand through the spring has been moderate, both “bearish” indicators. But when natural gas prices are in the mid $2/Dth, they aren’t far from reaching the bottom. That’s because at a certain point, and we’re close to it, it’s not worth it for natural gas companies to drill. When that happens, rigs get turned off and rig counts drop. Then guess what? Prices rise.

Again, today’s prices are very attractive. How attractive? Last summer, we saw natural gas prices rush past the $9/Dth threshold. Get caught on the wrong side of an upturn like that and your budget could get crushed.

I mean this in the nicest way: don’t get greedy. You won’t look like a hero if you wait and possibly save a few more cents, but you will look bad if you wait and watch a business-enhancing buying opportunity like this pass you by.

Here’s how I ended my last article last month. I’m sticking with it, especially with the EIA predicting the Q3 jump:

Your Playbook for Taking Advantage of Today’s Low Prices

Here’s your playbook for taking advantage of today’s market lows while protecting yourself from the bite of future energy-price spikes:

- Be Proactive. Transparent Energy can work with you today to assess your energy use, understand your cost parameters and risk-management needs, and pounce on savings opportunities. Don’t sit idly by and become an “order taker,” someone who goes to market at the last minute and takes whatever you get because your energy contract is about to run out. That approach could prove tragic. Instead, engage an expert like Transparent Energy who can help you be proactive, while bringing the best of the market to you each and every time, especially now.

- Develop a Risk-Management Strategy. Understand your short- and long-term pricing options. Have a plan in place to continue to manage away from risk to stay in line with budgets. Taking advantage of today’s favorable buying conditions now can help you take a lot of risk off the table.

- Know Your Options. Letting Transparent Energy bring your load to market and having suppliers bid for it – against each other – in a live auction is the best way for you to price the market, understand all its possibilities, and see and select the best products for your budget and risk tolerance. Price discovery of this sort does not exist anywhere else in the market and is absolutely priceless. Consider all your options, so you can make an informed procurement decision.

- Ensure You Leave an Audit Trail to Support Your Decisions. It is vital that you implement a process that shows why you bought energy at any given time and the steps you took to buy responsibly. By making informed decisions and cataloguing your strategy and the market conditions shaping it, you will write a legacy of competence.

Energy prices don’t stay low forever. Volatility is back. Working with an expert will help. Working with an expert now will help even more. Transparent Energy is that expert.