Transparent Energy has its collective finger on the pulse of the energy markets. To that end, it is our mission to identify and communicate with our clients when buying opportunities arise. As of today, we see a big green light buying opportunity!

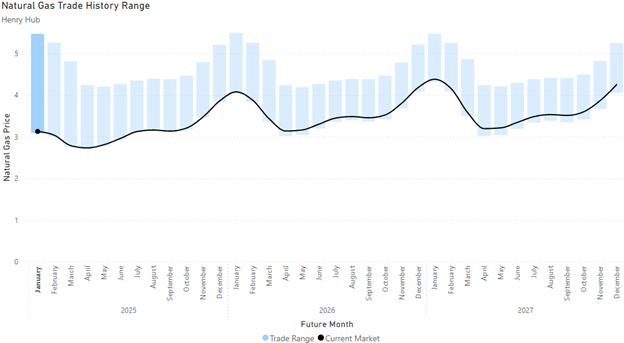

The chart above shows forward natural gas prices as they have traded over the past two years. Beginning at the left is a blue bar showing the trading range for the January 2025 NYMEX natural gas contract. Over the past two years, the cost for Jan ’25 gas has been as high as $5.425 per MMBtu and as low as $2.936. The black line indicates the price as of the November 4th settlement, which was $2.936.

| NYMEX NG Contract | Max 2-year Settle | Min 2-year Settle | Nov. 4th Settle |

| Jan 2025 | $5.425 | $2.936 | $2.936 |

From there, the chart continues to the right showing the 2-year trading history of NYMEX natural gas contracts for February 2025 through December 2027 (blue bars) as compared to the November 4th settlement (black line). The image offers striking insight: for customers looking to purchase natural gas to cover expected consumption in 2025, 2026, or 2027, now is the time to act.

Why? Because buying at or near the two-year low makes great financial sense. And, the odds of prices going lower vs. the odds of prices increasing is a bad bet. Keep reading to learn why.

How Does This All Work?

As with most commodities, energy products exist on financially traded futures exchanges that allow producers and consumers to manage the risk associated with price volatility. Natural gas contracts are traded on commodity futures exchanges like the New York Mercantile Exchange (NYMEX) and via over the counter (OTC) transactions using agreed upon volumes with contractually binding settlement specifications.

Natural gas contracts are typically combined into blocks of 10,000 MMBtu and traded based on delivery month for as much as 30 years into the future. The prompt month contract (currently December 2024) expires three business days prior to the first calendar day of the delivery month. With the Thanksgiving holiday, this means that the NYMEX Henry Hub natural gas December 2024 futures contract will expire on November 26th, at which point January 2025 will become the prompt month. For any gas users that have not secured a third-party supply agreement it means that the cost of natural gas for December will be determined by the expiration price plus a basis cost.

What is a Basis Cost?

Natural gas basis is defined as the difference in cost between any two pricing points. For most natural gas agreements, one of those points is the Henry Hub in Erath, Louisiana, although it could stand for the difference between any two physical locations. We use Henry Hub as the benchmark because it is a central distribution point for several major interstate pipelines and offers the most price liquidity and transparency.

Supply agreements for gas users across the country are typically written in terms of NYMEX last day settlement + basis cost. In areas of the country that are rich in natural gas production (like Texas or Pennsylvania) the basis figure is typically very low or even negative. A big part of basis pricing involves pipeline infrastructure and seasonality. Some of the highest basis prices occur in New England during the winter where gas pipes are constrained, and heating demand is extremely high.

Back to the NYMEX

The cost of NYMEX natural gas can be incredibly volatile, depending on several factors. The main drivers are stored inventory levels, domestic production, and weather-related demand. Occasionally geopolitical issues, infrastructure problems, or other factors send prices dramatically higher or lower.

So far in 2024, NYMEX settlement prices have averaged $2.16 per MMBtu, the lowest level since 2020 when the COVID-19 pandemic wreaked economic havoc across the globe. Since the turn of the century, NYMEX prices have settled as low as $1.50 and as high as $13.91 per MMBtu. Considering the possibility of an 827% increase in gas costs, it’s fortunate that these futures markets exist.

How Do Natural Gas Consumers Benefit?

While most end-users aren’t prepared to purchase wholesale natural gas contracts on the exchanges for 10,000 MMBtu per month (not to mention the collateral requirements), the retail market (populated by the energy suppliers you buy from) exists so you can enter into customized contracts that fit your consumption patterns and risk profile. Third-party suppliers will assume most of the price risk and offer fixed price agreements well into the future.

Typically, contracts can be offered to cover the next 5 years as the wholesale market for this period is relatively liquid. It is not unusual for a larger gas consumer to buy natural gas (for at least portions of their expected future consumption) for up to 10 years in advance.

Could Prices Go Even Lower?

So, could natural gas prices go even lower? Certainly…to an extent, but there are many uncertainties. When NYMEX contracts settled below $2 per MMBtu in the spring of 2024, major production companies like Chesapeake and EQT announced they would be scaling down their efforts to pull natural gas out of the ground due to economic factors. Simply put, it was not worth the effort to maximize production for minimal return on investment.

Or, put another way, it’s hard to fall out the basement window. Natural gas prices, and by extension the electricity prices they impact, can only go so low. Your biggest risk is to the upside. The safe money says lock in savings while you can and avoid upside risk.

The Takeaways

- Energy markets are extremely volatile.

- End-users looking to purchase natural gas for 2025, 2026, and/or 2027 can secure future prices close to as low as we have seen over the past two years.

- There’s more upside risk to your energy budget by not buying now than there is downside risk hoping the market falls even lower.

- It’s essential to work with a consultant like Transparent Energy to help optimize your procurement process.

###

Interested in learning more about market-pricing trends and their impact on your energy budget and energy-procurement strategy? Looking for help extracting the best price from energy markets to power your business while reducing your risk exposure? Contact Transparent Energy today at letstalk@transparentedge.com.