If you are a large energy buyer looking at today’s pricing environment, you have a right to be confused. The 2020s have been crazy!

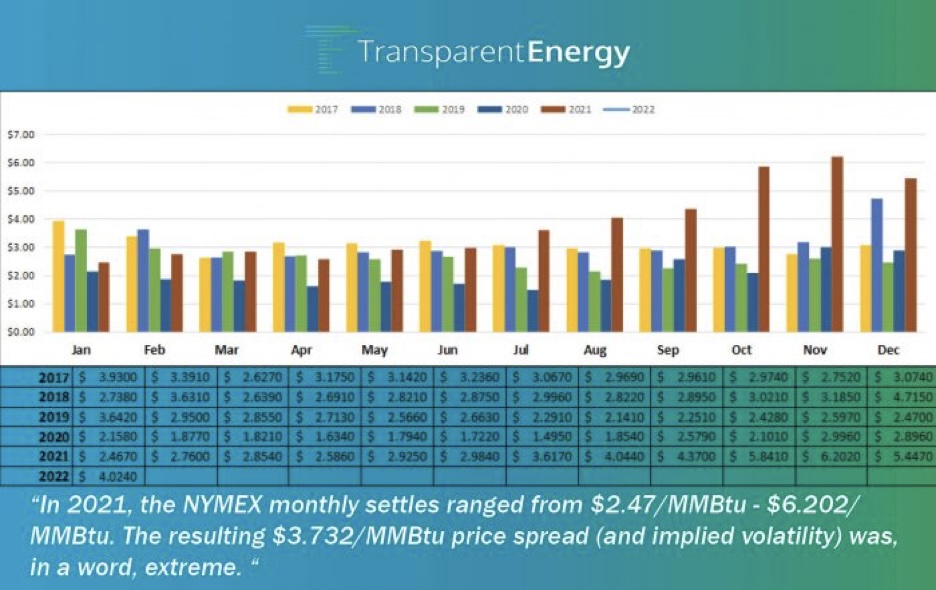

In 2020, years of warmer-than-usual winter weather combined with the demand destruction of the pandemic culminated in record low natural gas prices. Then, in 2021, the opposite happened. It was as if someone flipped over the hour glass. Prices surged and extreme volatility took hold.

Ironically, our overarching advice both years was “buy now before it’s too late.” In 2020, the call to action was “buy now – and go long – because there’s only one way for prices to go from here – up!” And up they went. In 2021, we urged large energy buyers, amidst rising prices, to get in while they could, because a new normal of high energy prices was coming.

In 2022, that new normal is here. Demand for energy remains high – not just in the U.S., but around the globe. And supply is not rising at the pace of demand. Throw in a shift to natural-gas-burning power plants as a bridge to decarbonization, as well as the omnipresent threat of climate/weather-related impacts on the power grid, and we have the makings of relatively expensive natural gas and electricity prices for the long term.

Put another way, those historic lows of 2020 are not likely coming back anytime soon.

So what should you do? You still have a business to run. That means buildings to light and heat, manufacturing lines to power, data centers and warehouses to operate 24×7. And that also means, whether prices are high or low, you’ve got to procure energy.

Back to Reality and Back to Basics

The flip-flop in energy prices and dramatic rise in volatility over the last year brings us back to some time-tested truths: 1. Energy markets are inherently volatile. Therefore, 2) Managing risk should be a key goal of your energy procurement strategy.

So how can you both protect your business against price volatility while also keeping energy costs in check? Here are a few pointers, but first consider this summary from the Energy Information Association (EIA), an independent government agency monitoring U.S. energy markets, in its January 2022 report, “Wholesale electricity prices trended higher in 2021 due to increasing natural gas prices”:

Natural gas prices have remained relatively low in recent years; the cost of natural gas delivered to electric generators averaged $2.40 per million British thermal units (MMBtu) in 2020. However, natural gas prices trended higher over the last year. The delivered cost of natural gas to electricity generators grew from $3.19/MMBtu in January 2021 to an estimated $5.04/MMBtu in the fourth quarter of 2021.

That’s a year-over-year increase of more than 30% from 2020 to 2021, and nearly a 60% in-year jump over the course of 2021. For all energy consumers, those are painful spikes. For energy-intensive industries, they pose an existential threat.

Again, that’s a lot of turbulence – and with it a lot of risk for energy buyers. This isn’t a market for you to take big chances in, nor is it one to enter into without professional help. Here are some suggestions to help:

PLAN NOW. Get ahead of your energy needs by partnering with a market expert well in advance of your current contract expiration date.

Energy markets are volatile by nature, so you need to get out in front of them, monitor them and leverage all the intelligence you can gather and transactional expertise you can muster in order to procure energy at the best time and price to meet your business goals and risk management tolerances.

What this really boils down to is that you need to work with a partner who is in the market every day so you can take advantage of opportunities – i.e., dips – when they occur. Retain a partner 12-18 months in advance of your contract expiration date, so they can pounce on any market softness to get you the best price and product for your energy budget.

Time and time again, we see commercial, industrial and institutional energy buyers wait until the last minute, i.e., right before their energy contract expires, before they go to market. Occasionally they get lucky, but more often than not, they get burned. Don’t be that company. “Hope” isn’t a strategy. Let energy procurement specialists, ones steeped in the energy markets and advanced risk management strategies, help get you in the right contract at the right rate to meet the needs of your business.

Increase competition for your energy business by procuring via an online auction.

How you buy energy really matters, especially in a difficult pricing environment. The price you pay for the energy commodity itself is the biggest factor in your energy budget, so it is essential that you use the best process to extract the best price from the market. The best process involves the use of online auctions to engage a large pool of suppliers to compete aggressively to win your business.

So be sure to partner with an energy procurement firm that uses online auctions and has a track record of increasing supplier participation in its pricing events. Healthy competition is your friend in any energy pricing environment, but it is your best friend when prices are high and every penny counts.

Repeat steps 1 and 2 to get greener faster and at less cost to meet your ESG goals.

The energy procurement process works for more than purchasing natural gas and traditional electricity; it can be leveraged to purchase renewable energy credits (RECs) and other green-energy products. A well-designed auction can and should easily include pricing for renewable energy, enabling you to go to market once to meet all your clean and traditional power needs, while advancing your corporate sustainability goals.