3Qs with Paul Shagawat, Co-Founder and Managing Partner, Transparent Energy

Q: Even before Russia’s invasion of Ukraine, Transparent Energy had been warning large energy buyers of increased price volatility. What’s your take on energy markets today, factoring in the Ukraine situation?

Global affairs have always played a strong role, often a dominant one, in energy markets, as we depended on foreign nations for the bulk of our oil and natural gas needs. That started to shift here in the U.S. during the natural gas boom brought on by fracking, which really flipped the script and recently turned the U.S. into the world’s largest LNG exporter.

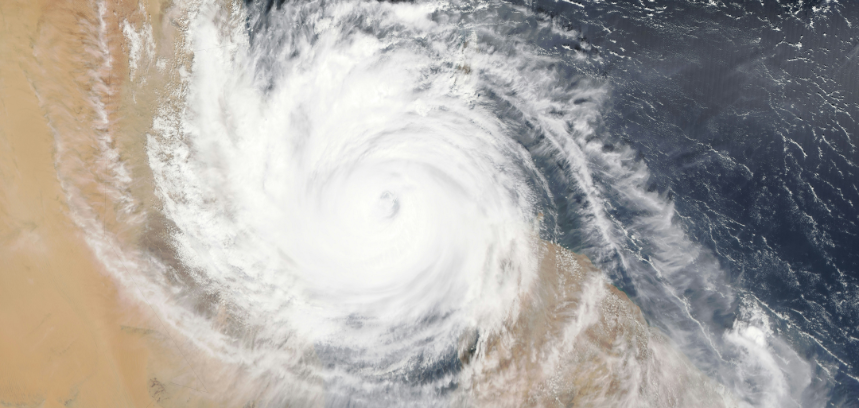

As rig counts rose and natural gas supplies increased, natural-gas-powered power plants grew in popularity, retiring high-polluting coal-powered plant, and drove down electricity costs. For many years, large buyers of energy enjoyed predictably low energy costs, and the biggest factor endangering low prices was weather. For example, The Polar Vortex of 2014 and its aftermath rattled energy markets for more than a year, while last year’s deep freeze in Texas sent shockwaves throughout ERCOT and beyond. But it didn’t only take extreme weather to move the market; back then, a week of hotter or colder weather than forecast constituted a volatility event.

That narrative though has changed – a lot. I remember in 2020, at the outset of the COVID-19 pandemic, urging clients to capitalize on historically-low energy prices, going out long to hedge against future uncertainty. That advice turned out to be spot on, because 2021 re-introduced extreme pricing volatility to the market. We’ve written a lot about why that happened, but for now let’s just say that as energy demand decreased during COVID and rig counts fell, natural gas also established itself as the fuel of choice (a cleaner burning fossil fuel) as the world ramped up renewable-energy projects. Global demand surged, but rig counts remained low, and prices started to spike.

We strongly believe those really low lows of 2020 are a thing of the past. That can be a scary thought for many businesses and institutions where energy costs are a major operating cost. High energy costs have a sneaky habit of creeping into all aspects of the economy, making it not only more expensive to heat and light your buildings and power your manufacturing lines and data centers, but also increasing the cost of moving goods and people.

As scary as the pricing environment is today in energy, it still rewards level-headed thinking and a proactive approach. You have to go back more than a decade to 2008 to see February settles for natural gas this high. But just as we did back then, we have helped our customers anticipate this pricing environment and hedge against it effectively.

In terms of being proactive, we are helping many large energy buyers look years ahead where there is currently some opportunity in the market due to backwardation, i.e., energy right now is cheaper the farther out you go. This is about preparing them to act when it best suits their business needs. For those who take a proactive approach, when you buy power is something you can control, and that control almost always leads to a better handle on energy costs.

I’ll be blunt here. During those good times when natural gas prices were low and getting lower, and volatility was stunted by warm winter weather and decreasing demand, large energy buyers could procure energy themselves or use a broker or a friend and likely save money compared to prior contracts.

That’s not the case anymore.

Energy buyers need a more sophisticated approach to procure energy in this highly volatile and complex environment. At Transparent Energy, we’ve literally put in our Malcolm Gladwell-ian 10,000 hours to master energy procurement (to prove it, we’ve run more than 10,000 auctions) – our process, our technology, and our people are second to none, and that’s an advantage that translates into better pricing and risk management for our customers.

Q: Along those lines, Transparent Energy recently experienced one of its busiest, most productive weeks. Can you tell us a little about that?

You’re right. We just had one of the biggest weeks in company history.

What’s really happening here is that the largest energy buyers in the country have taken notice of Transparent Energy. They’re reading our Market Intelligence reports and thought leadership articles and understanding that in order to manage energy costs, and become greener, they need to work with a process-driven company that is 100% focused on the energy markets every day and very adroit at transacting within them.

We’re winning business with big energy buyers for whom compressing energy margins is vital to their bottom-line performance: data centers, manufacturers, crypto miners, cannabis cultivators, real-estate-investment trusts (REITs), private equity groups, and investment banks. They are working with us to look out to 2024, 2025, 2026 and beyond and greatly value getting hundreds of unique bids in our auctions. They like what they see and love the results so much that they are actively institutionalizing the Transparent Energy’s energy-procurement process across their holdings. What’s also encouraging is these same companies are now working with Transparent Energy to meet their carbon neutrality goals, not only by buying RECs, but also pursuing community solar, PPAs and VPPAs.

All of this to say, the new normal of energy markets being dominated by higher volatility and complexity is forcing a reckoning: energy buyers are now looking closely at their existing brokers. When they don’t like what they see – a lack of process, a lack of sophistication, a lack of technology in the hands of true market experts – they are signing on with us.

Q: How do you see the large-scale embrace of sustainability planning and renewable energy by the business sector shaping what you do at Transparent Energy?

I see it as both an extension of our core energy-procurement services and an exciting growth driver for the company.

I love it when we help our customers buy RECs and green their portfolios, something we have been doing for years and which has gained a lot of momentum over the last year. But we’ve entered an era of utility-scale renewable projects that corporate energy buyers can participate in, large-scale efforts with true additionality via power purchase agreements (PPAs) and virtual power purchase agreements (VPPAs). This is a very exciting opportunity for Transparent Energy and our customers.

At our core, we are a company that provides full transparency into energy markets – renewable energy markets included. It’s just that we are able to do this now on larger-scope renewable deals with longer term lengths. But our value proposition remains the same: through our competitive process we help our clients get the most value from their energy purchases. Additionally, because we are in the market every day and working with so many energy suppliers, project developers, and customers, we are armed with so much information and are often able to put great projects in front of potential buyers that would have never have had the opportunity to uncover them on their own.

I don’t want to pretend I have a crystal ball, but I also see the overall higher, more volatile pricing environment in traditional energy benefitting renewables. And as technology, AI, and even blockchain improves, I see potentially dramatic cost reduction in renewable energy generation in the near future.

No matter how that pans out, the health of the planet is at stake, and large energy buyers of all stripes have made their net-zero carbon pledges. Buying renewables at scale is the next frontier, and it’s happening right now.

As usual Transparent Energy is right there and adding value.