If your energy contract ends in the next 18 months, you should be in emergency mode to manage away from risk and start budgeting for potentially large energy-price increases. And your phone or your inbox should be full of communications to assess this risk while you still have options.

If your energy consultant or in-house energy procurement team is not raising the alarm bell loudly at this very moment, then you are about to walk into a 30%-100% electricity and natural gas rate increase compared to your last agreement. Yet this is TOTALLY AVOIDABLE, if you address this situation now by abandoning whatever approach you are currently taking and work instead with a company that provides proactive information and options on market fundamentals so your budgets can stay intact.

Consider the following:

“Businesses that do nothing to manage their energy costs today could wake up to energy supply charges 20-30% higher this winter than what can be secured right now in today’s markets.”

You know who said that? I did.

Do you know when I said it? September 8, 2020! (And, by the way, it’s just as true today as it was back then.)

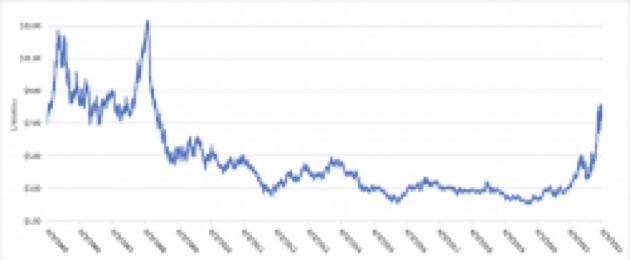

That’s right. For nearly two years, Transparent Energy has been repeatedly sounding the alarm to any large energy buyer who would listen that a) the historic natural gas and electricity lows of the summer of 2020 were a temporary phenomenon and b) that the best possible course of action was for buyers to “go long,” locking in those low prices as long as possible, hedging, i.e. reducing risk, against rising prices.

Many large energy buyers listened. In fact, thousands did. We’ve noticed it in our 2022 deal flow. While Transparent Energy transacted record energy volumes for clients in Q1 of 2022, a large majority of that deal flow was from new customers. That’s because we had already taken care of many of our existing customers: squaring them away with multi-year electricity and natural gas contracts so that today’s prices which are anywhere from 20-100% higher (with futures pricing still posing considerable risk), aren’t impacting their businesses.

Which brings me back to you. If you are reading this article and this is the first time you are being forced to consider that you face a potentially very large energy price increase unless you address this now – give us a call. We will share data and facts with you to consider, as well as a proven procurement methodology that can secure your power needs at a reasonable rate while you still have an opportunity – but the time is NOW!

Still not convinced? Consider this:

The Federal Government has been sounding the alarm for businesses across the country via two key communications. First, the Federal Energy Regulatory Commission (FERC) recently issued its 2022 Summer Assessment warning of “summer volatility.” That unsettling report was quickly followed by another from the Energy Information Agency (EIA), this time forecasting “price volatility” for the balance of 2022! Both assessments follow:

So what does this mean for you? Translation: Energy prices will be VOLATILE and potentially HIGH for the balance of 2022, which in turn means that prices will rise, perhaps materially, in 2023 as well – that’s just how these markets work. Again, if this is news to you, let’s talk about it.

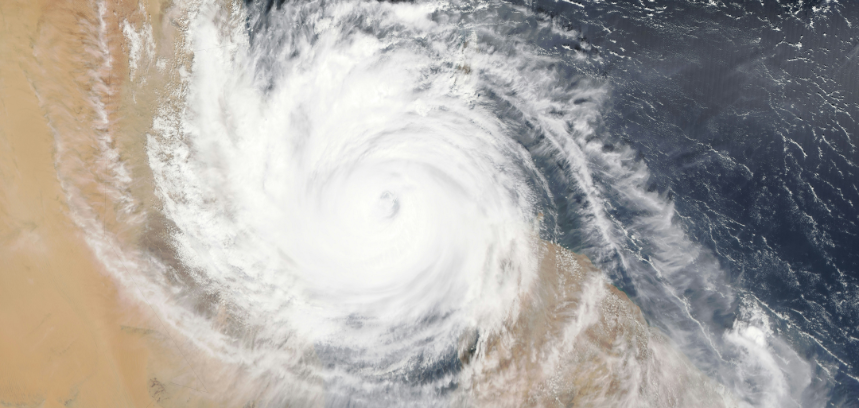

Further, you should know that understanding the “perfect storm” of fracking, warm winters, and reduced energy demand caused by the COVID-19 pandemic – all of which drove natural gas prices down to record lows in 2020 – would eventually shift into a highly volatile market dominated by increased global energy demand, extreme weather events, and an era of US-led LNG exports – all of which are reasons why natural gas prices have been driven up to today’s highs (and even higher futures) – wasn’t a matter of fortune-telling.

When Transparent Energy went on the record month after month for nearly two years warning of these increases, it wasn’t because we were clairvoyant. Rather, we looked at the data objectively and advised accordingly.

So what then was your energy consultant doing?

Were they looking at the data? Were they sharing important findings with you?

Moving Forward

So what can you do about it? First, you need to fire the energy consultant that got you into this mess. Either they weren’t taking the market seriously or, worse, they weren’t taking you seriously. Either way, you can’t make a change fast enough.

Next, partner with an expert familiar with the data, one who leverages process and technology on top of market intelligence to always get you the best available price in the market. At Transparent Energy, we are looking at the market every day and the bullish and bearish forces that are driving it.

We not only track this information, we write about it frequently, and we always discuss it with our clients. For the record, I’ll be sharing our very freshest insights with you soon in a follow-up article to this one, but for now just know that these markets are extremely volatile and, despite a temporary downturn caused by an onsite LNG explosion, the long-term fundamentals show potentially high prices for the foreseeable future.

That means if you have energy contracts expiring this year or next, consider this as an URGENT CALL TO ACTION. You need be talking with us NOW to gain any edge possible to protect your budget. There are some pockets of savings available, but those doors may be closing soon.

It’s time for you to get serious about energy and partner with someone who already is – Transparent Energy.