By Brendan Boyle, Transparent Energy, February 2024

Introduction

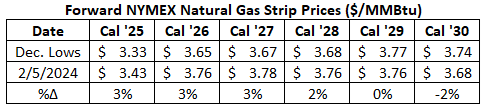

In our latest whitepaper, Transparent Energy highlights the importance of being prepared to act when an opportunity presents itself in the energy markets. In December, we drew attention to the 12-month natural gas strip, which had fallen to its lowest price point in more than three years due primarily to record-breaking domestic production and a mild start to winter.

In mid-January, a flurry of winter storms brought snow, heavy rain, and high winds across most of the country, causing freeze-offs at natural gas production wells along with a near-doubling of heating demand in the residential/commercial sectors. The natural gas market reacted quickly, as the Feb ’23 contract gained more than 40% in just a few days. As conditions stabilized over the past few weeks, however, prices have reverted closer to the December lows.

That’s good news for energy buyers.

Further out on the curve, prices have barely moved from December’s multi-year lows, which is more good news:

Yet low prices, don’t mean zero risk. Volatility and near-term price spikes are always a threat, especially during periods of extreme weather. Taking a longer-term approach will allow you to protect against this seasonal volatility while taking advantage of low-cost energy for years to come. Now is the time to be proactive, because pricing is so favorable. Waiting to procure energy introduces risk, as market conditions are constantly in flux.

What’s Driving Current Energy Market Lows?

One of the hallmarks of the recent run of low-cost energy in the U.S. has been the steady growth of natural gas production. Dry production in the Lower 48 states reached an all-time monthly high of 105.5 bcf per day at the end of last year, following several years of 4-5% annual growth. In its latest Short-Term Energy Outlook, the EIA forecasts U.S. gas production to decrease in 2024 to around 104 Bcf per day due to several factors:

- Natural gas-directed drilling rigs have decreased 26% from a year ago and 42% from the pre-pandemic apex (actual production typically lags a drop in rigs by several months).

- Consolidation in the drilling sector.

- Low price environment has disincentivized new production.

Baker-Hughes CEO Lorenzo Simonelli echoed these sentiments in a recent earnings call, saying: “We are now anticipating no meaningful recovery in (drilling) activity during the first half of the year.”

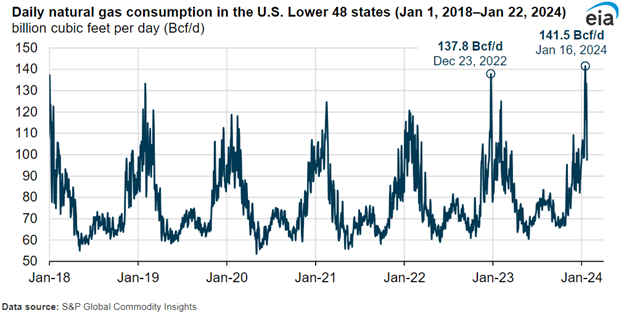

Together, these observations raise some concern, as the U.S. inventory surplus vs. the 5-year averaged has fallen from +13% on December 29th to +5% at the end of January. Energy prices are still ruled by supply and demand, and a shrinking surplus could lay the foundation for rising prices in the future.

In addition to the potential production stagnation, natural gas is being consumed at record levels, as demonstrated on January 16th when an all-time high of 141.5 Bcf was established:

The addition of a new fleet of LNG terminals over the next 3-4 years will only further drive the world’s appetite for natural gas produced in the U.S.

So, shrinking surpluses meet growing global demand for natural gas. We know where this leads, and it’s not to bargain-basement energy prices for your business.

From an electricity perspective, these same messages apply, but to an even greater extent. The EIA estimates that cryptocurrency mining operations currently account for 1-2% of total electric consumption. That figure is expected to grow swiftly as the industry grows and the need for energy-intensive data centers continues to expand. Perhaps an even larger factor to consider regarding the future of electricity pricing is the immense strain the grid will experience as the electrification of the heating and transportation sectors continues to unfold.

Fossil fuels (mostly coal and oil) will continue to be phased out over the coming years and decades. Those continuously operating facilities will be replaced primarily by intermittent renewable generation. This means that price volatility is here to stay and is likely to become even more unpredictable in the future.

Which brings us back to today. There is an inherited wisdom in the industry about waiting until the “shoulder months” (March-April, September-October) to purchase energy; however, today’s conditions point to opportunity now.

Why wait?