Introduction

Most businesses face three major challenges when working to optimize costs: people, infrastructure, and energy. People are the most important due to the nature of humanity and the incredible skill and fortitude required to drive a successful business. Property, plant, and equipment are essential in many verticals but have become less vital in others in the aftermath of the Covid-19 pandemic. In both cases, the cost of people and infrastructure is relatively static, in line with inflation which varies by 2-5% annually. There are certainly exceptions, but the volatility of these cost inputs pales in comparison to the unpredictability of the cost of energy.

Today there are so many variables driving the cost of electricity and natural gas – politicians, environmentalists, scientists, academics, corporations, and weather.

Last week, the March 2024 natural gas contract settled at $1.615 per MMBtu, which was the lowest settlement price since July 2020. Forward price strips for 2024 through 2030 are all trading below $3.80 per MMBtu. This is important to note because we have seen prices more than 2-3x that rate on multiple occasions:

- In 2005, the 12-month natural gas strip peaked at $12.71 per MMBtu.

- In 2008, the 12-month natural gas strip peaked at $13.33 per MMBtu.

- In 2022, the 12-month natural gas strip peaked at $8.28 per MMBtu.

There are distinct reasons behind these price spikes, but in each case the run-up was unforeseen. Current market fundamentals point to continued bearishness in the natural gas market, but technical indicators tell us that prices can only go so low. For example, after reaching a high of 105.5 Bcf per day in December 2023, natural gas production has dropped to 100.4 Bcf per day, signaling a reduced appetite among drillers to continue producing natural gas at sub-$2 per MMBtu prices.

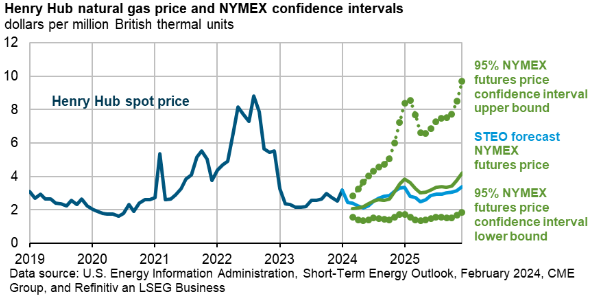

The Energy Information Agency (EIA) has by far the most data surrounding energy consumption in the United States. In its latest outlook, the EIA projected with 95% confidence that the price of natural gas would not fall below $1.60 per MMBtu, and with 95% confidence that the price of natural gas would not exceed $10 per MMBtu:

That is a huge spread of potential outcomes, and the upside potential clearly outweighs the opportunity cost to the downside.

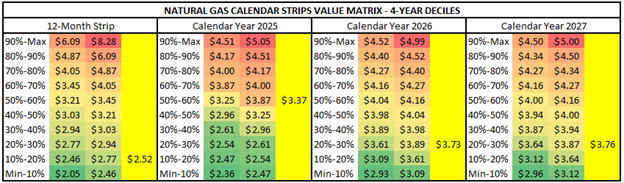

The takeaway here is that energy prices move quickly, and current conditions indicate the need to buy now. Even if your business is under contract there is a compelling case to blend and extend or look at renewing while the market is in your favor. Below is a look at where current prices are tracing vs. the 4-year trend. Example – the 12-month strip is trading in the 10%-20% decile, meaning that over the last 4 years, the cost to purchase a 12-month natural gas contract has been higher than today’s price more than 80% of the time:

Natural gas remains the primary driver of electricity prices because gas power plants fuel most peak electric usage. Even as we enter the age of renewable energy, natural gas will continue to set the price of electricity since it is not an intermittent resource like solar, wind, or hydro power. While natural gas can be stored underground or shipped away in liquified form, electricity presents different challenges. Battery technology is advancing at a rapid rate; however, the nature of electricity markets dictates that supply must meet or exceed demand in real time.

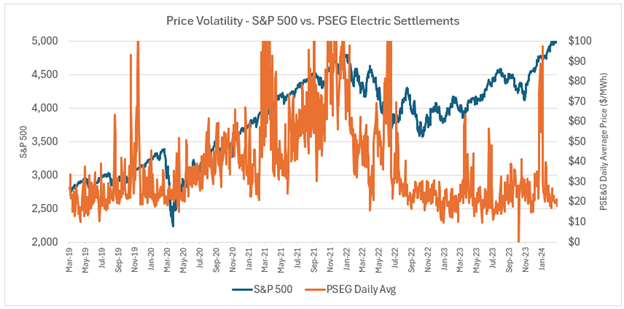

Below is a chart showing the price volatility of electricity in the PSE&G service territory of New Jersey vs. the S&P 500:

Comparable results are evident in territories across the country. Even during a period of strong natural gas production, high inventories, and mild weather, the price of electricity fluctuates dramatically due to the unpredictability of supply and demand.

The bottom line for your business is that:

- Energy prices out to 2030 are extremely low compared to the peaks we have seen in recent years.

- Opportunity to the downside is limited.

- Regulatory changes (including the phasing out of coal, oil, and less efficient natural gas power plants for more intermittent renewable resources) are being implemented that will introduce more price volatility, impacting future energy cost.

- 2024 elections in the U.S. and Mexico will shape energy markets for at least the next 4-6 years.

- Transparent Energy is uniquely suited to provide the technology, process, and expertise to help your business secure low-cost energy and renewable solutions for the rest of the decade.

As I discussed in my article last month, waiting to act on today’s low energy prices only introduces more risk. The time to take control of your energy costs is now – please contact your Transparent Energy advisor to secure the future costs for your business. If you don’t already have a Transparent Energy advisor, reach out to us at letstalk@transparentedge.com.