By Brendan Boyle, Director, Market Intelligence, Transparent Energy

Over the past 18-months, energy markets have retreated from the elevated levels of 2022 and volatility has declined – good news for large energy buyers. Recent price movements that have occurred continue to prove that weather causes the biggest fluctuations in the short term. On a macro level, energy prices change primarily based on expectations around supply and demand. Natural gas inventory levels and the electricity reserve margins drive long-term energy price trends.

So, with these basics in mind, let’s look at where we are today, and how we got here.

By the start of 2023, the massive natural gas storage deficit (as low as -367 Bcf vs. the 5-year average in 2022) had turned to a +678 surplus. There were two primary factors that aided this bearish transformation:

- Consecutive warmer-than-normal winters (lesser demand for gas, particularly in the residential and commercial sectors).

- Record-setting U.S. natural gas production (more than 105 Bcf per day by the end of 2023).

On the bullish side of the coin, U.S. LNG exports established new records over 15 Bcf per day, with plans for that figure to increase steadily for the rest of the decade and beyond. Also, natural gas demand in the power generation sector has never been higher.

In 2024, with a healthy gas storage balance and adequate electric supply, prices have ebbed and flowed based on weekly news and temperature forecasts, but the overall trajectory has shifted lower. General market sentiment says that despite a recent tightening in the inventory surplus, the U.S. will enter the upcoming winter with ample gas reserves, and that supremely cold winters of the past are growing more unlikely.

The National Weather Service provides average annual temperature data for the United States dating back to 1875. The past 10-years (2014 – 2023) are the ten hottest on record, and 2024 will almost certainly extend that streak. While this certainly leads to intermittent price spikes during particularly hot summers, the big picture market view focuses on what will happen if the recent streak of warmer-than-normal winters continues.

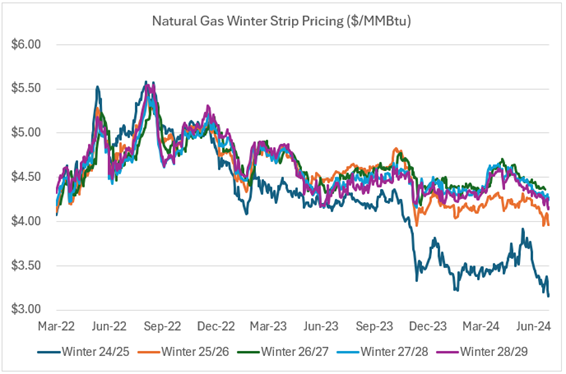

The consensus opinion is that prices will remain low and generally stable for the predictable future. The chart below shows a twenty-eight month history of the forward price of winter natural gas strips. This means the average of the upcoming November through February NYMEX natural gas contracts for the next five winters (for example, the Winter 24/25 price includes the Nov ‘24, Dec ‘24, Jan ‘25, and Feb ‘25 futures contracts):

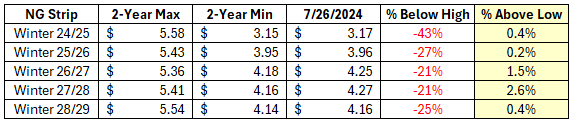

Here is a look at the data behind the chart showing just how close today’s prices are to the two-year lows, and how far prices are below the two-year highs:

The takeaway from this data is that the current cost to buy natural gas for upcoming winters is very close to as low as it’s been since March 2022. Winter gas prices are historically the most expensive and volatile, so securing these modest rates today will go a long way towards driving down costs for both natural gas and electricity for years to come.

The forward strips consider the fundamental expectation that natural gas storage will remain favorable, that extended periods of winter cold will not occur, and that production will continue to grow to offset the increase in natural gas exports. They do not take into account the possibility of unforeseeable events or changes in the supply/demand balance that would send prices significantly higher. Because of this, we see today as a fantastic opportunity to secure low-cost energy and remove those risks from your energy budget for the foreseeable future. The time to act is now.

###

To learn how Transparent Energy can help you with your energy procurement needs, including gaining ongoing access to market intelligence insights like these, contact us at letstalk@transparentedge.com.