By Brendan Boyle, Director, Market Intelligence, Transparent Energy, January 2025

Every Thursday at 10:30 AM

Across the energy industry, one of the most utilized data points is the working gas in underground storage report, as provided by the U.S. Energy Information Administration. Every Thursday at 10:30 AM Eastern time, the EIA releases an estimate of natural gas volumes held at underground storage facilities in the Lower 48 states across five regions (East, Midwest, Mountain, Pacific, and South Central).

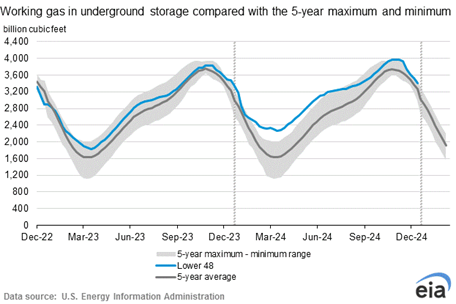

Energy suppliers, traders, and market participants pay close attention to the weekly changes highlighted in this report as they provide a sign of how much natural gas is readily available for consumption. Figure 1 below is a commonly referenced chart comparing natural gas inventory levels across time.

Figure 1

Why This Data Matters

The metrics most widely referenced in this report compare current inventory levels vs. the same week during the prior year, and vs. the 5-year average. The graphic above shows current year inventory as the blue line (3,413 Bcf as of 12/27/24). Prior year inventories were 3,476 Bcf as of 12/29/23. The shaded grey area shows the range of outcomes over the past five years (the average inventory level in late December from 2019-2023 was 3,259 Bcf).

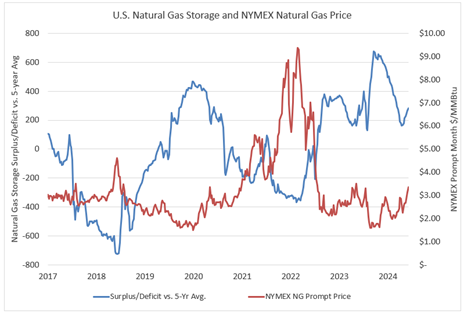

This information is useful as a basic economic tool. Higher inventories are most often correlated with lower natural gas prices. The opposite is true as well: when inventory levels fall, prices tend to move higher. Figure 2 below shows the inverse relationship between storage levels and price. Given that gas storage is currently 4.7% above the 5-year average, it is generally accepted that U.S. gas inventories are in a very healthy position.

In fact, on November 8th of this year, inventories reached 3,972 Bcf, which was the highest level recorded since 2016. This is often referenced as a reason natural gas prices are currently trading at lower levels compared to prior years.

Figure 2

Easy, right? Not so fast!

What’s Needed: A More Granular View of Natural Gas Supply and Demand

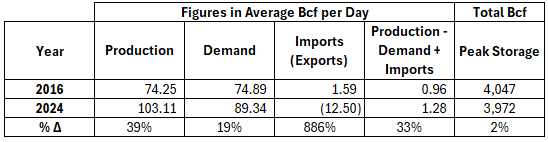

While the EIA inventory data is helpful, it’s important to remember that the natural gas market continues to evolve, and a lot of changes have occurred since the five-region structure debuted in 2015. Figure 3 below shows key fundamental factors contributing to inventory levels.

Figure 3

Over the past eight years, we’ve seen significant growth in terms of U.S. dry natural gas production (+39%), total natural gas demand (+19%), and net imports are now net exports with the growth of LNG output combined with pipeline gas going into Mexico.

So, while current inventories are within 2% of the lows experienced in 2016, the amount of gas being consumed daily is 19% higher!

We need to look at the EIA’s storage data in a different light.

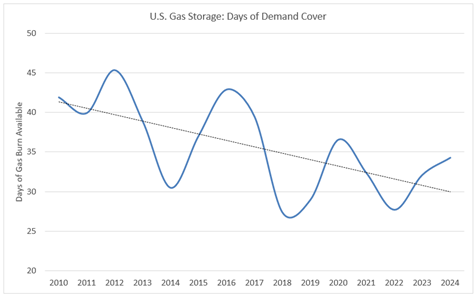

If we divide average annual inventory by average daily demand, a different, more nuanced picture emerges. Figure 4 below shows storage inventory levels in terms of days of burn available.

Figure 4

In 2016, the amount of gas stored in U.S. inventory was enough to supply the country for 42.9 days on average. Meaning that if natural gas production, imports, and exports ceased the U.S. would burn through all its natural gas in just under 43 days. In 2024, that number has decreased to just 34.3 days. While absolute natural gas inventories are above average, when compared to demand, storage continues to move lower.

This lack of storage relative to demand is due mostly to natural gas’ growing share in the power generation sector. The data center and AI boom, coal plant retirements, and the intermittent nature of renewables have amplified the importance of natural gas. As this ratio shrinks, the market turns to price ($/MMBtu) as the primary mechanism used to balance inventories, leading to a more volatile pricing market.

Key Takeaways

Remember, energy markets are in a constant state of flux. Even the most reliable reports do not always tell the complete story.

A more volatile pricing environment, like the one we are entering in 2025, creates risk – and opportunity – for large energy buyers. It requires a more strategic procurement approach to ensure your next buy advances your business goals and minimizes your exposure.

While no one can say for certain where energy prices are headed, several indicators suggest that volatility is increasing – and here to stay. Transparent Energy is ready to help you succeed in this more demanding pricing environment.

###Looking for help assessing your buying opportunities in today’s more volatile energy markets? Contact us today at letstalk@transparentedge.com.