By Paul Shagawat, Co-Founder and Managing Partner, Transparent Energy

Over the last couple of months, there has been an onslaught of media coverage across outlets, from CNBC to the Wall Street Journal and Washington Post, with more or less the same thesis: AI is a power-hungry (as in electricity-consuming) tidal wave crashing in on an ill-prepared power grid. What often isn’t said, is that this spike in demand is going to drive natural gas and electricity prices up – potentially way up.

Ironically, one canary in the coal mine has been Microsoft, a “Magnificent Seven” company leading the AI charge. In late 2022, its CFO revealed the company would be paying an extra $800M in energy costs to support global data center growth.

That’s a lot of unforeseen cost. So. Please. Take. Note. The seemingly sudden surge in electricity demand everyone is now talking about is projected to continue unabated for a long time (look no further than Texas’ loan program for an additional 41 GW of gas-fired generation projects).

Whether you saw this coming or not, it’s time to prepare now for a much more volatile – and expensive – era in energy.

So, how best to do that? Large energy buyers, read on.

Energy Markets Can Turn Quickly

I want to start your preparation by sharing an insight gleaned from recent natural gas history. Why natural gas? Because natural gas is the most commonly used fuel to generate electricity across the U.S.

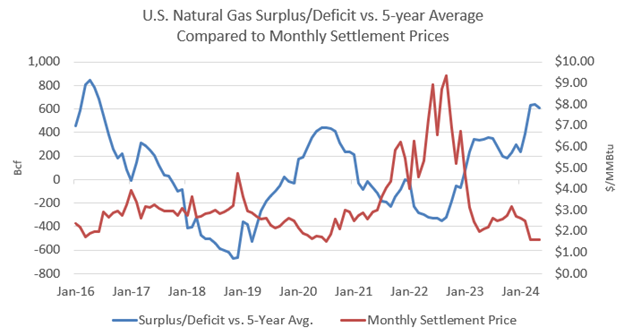

Consider the chart below, which shows the inverse correlation between natural gas storage inventories and natural gas prices. Generally speaking, when storage levels (as shown by the blue line) are high, prices (represented by the red line) are low.

Earlier this year, we saw the inventory surplus vs. the 5-year average reach a high of +678 Bcf (and gas prices settled below $2 per MMBtu). The last time we saw such a large discrepancy was in March 2016 when the difference was +874 Bcf. But watch what happened later that same year. By the end of 2016 and into 2017, slowing production and higher demand turned the surplus into a deficit of -79 Bcf, and natural gas prices shot 57% higher!

I bring this up to underscore that fast, big swings in natural gas prices happen. And guess what? Many signs suggest we are about to experience such a swing now. If there is a precipitous swing upward in natural gas prices – and bullish factors far outweigh bearish ones – it is imperative that you be on the right side of it!

Electricity demand is on the verge of going through the roof, driven by the AI and data center boom (Microsoft’s latest data center plans recently made national news), and ongoing crypto mining and electric vehicle adoption.

But don’t just take our word for it.

A recent Yahoo! Finance article noted JPMorgan analyst Natasha Kaneva forecasting “natural gas is poised to be the No. 1 performer among commodities this year, ahead of gold,” and saying, “Although we still very much like gold as a structural multiyear bullish story with an updated price target of $2,600/oz, US Henry Hub natural gas has moved to the top of our list. We believe no other commodity can match its return potential this year.” (Emphasis mine.)

This may be great news for natural gas investors, but not for companies sourcing large quantities of power and natural gas to run their businesses.

Thankfully, there is a bright spot here for corporate energy-sourcing professionals – natural gas prices today are still relatively low. But this comes with a caveat: they very likely won’t be as low as they were the last time you went to market.

This, however, has nothing to do with the cost of the commodity itself. Natural gas prices are relatively low – historically speaking, still a bargain – but not low enough to outweigh all the ancillary costs driving electric bills up (a topic for another day, but for now just know that all of the other costs listed on your electric bill beyond the cost of the commodity are rising, driven by the cost of grid modernization and the adoption of renewable energy).

What’s to be Done?

Word to the wise: there is a buying opportunity right now, but it’s one we worry will close quickly. Given that, here are four things for you to keep in mind and do to increase your chances of energy-sourcing success:

- A once-in-a-generation surge in electricity demand created by AI and the data centers will very likely drive prices of natural gas and electricity up, and not just for the short term, possibly making the 60% hike we noted earlier look modest by comparison.

- Your best chance to protect your business from this potentially budget-breaking spike is to buy now before it happens, while prices are still relatively low.

- Buying now is only the half of it. The other half: go out as long as you can! The longer your energy contract, the greater your chance of insulating yourself from the impacts of a long-term bull market in energy.

- Because energy prices are higher now than they were the last time you went to market, don’t expect “savings.” What you’ll get instead is “price protection” (avoided cost from a rising market), and it may just save your business.

###

For more information on today’s energy markets, including electricity, natural gas, and renewables, and how you can most effectively source your energy, contact Transparent Energy at LetsTalk@Transparentedge.com.