By Brendan Boyle, Director, Market Intelligence, Transparent Energy, October 2024

Introduction

At the Transparent Energy Market Intelligence desk, we focus a lot of our attention on the wholesale electricity and natural gas markets that drive price trends and volatility. The wholesale price of natural gas is largely determined by inventory levels, the rate of production vs. consumption, and imports compared to exports. Basic economics of supply and demand determine the cost of natural gas at the NYMEX Henry Hub in Louisiana (the national benchmark price) and at each physical delivery point.

Electricity is a bit different, because it is a secondary energy source, meaning it is produced by converting primary sources such as natural gas, coal, nuclear, solar, and wind energies into electrical power. Natural gas sets the price for electricity not just because it is the most commonly used fuel for electric generation (it is at more than 43% nationwide), but because it acts as the marginal fuel of generating units that operators dispatch to provide electricity. As such, the correlation between the price of NYMEX natural gas and wholesale electricity is above 90% in deregulated ISOs and RTOs across the U.S.

Other Cost Components

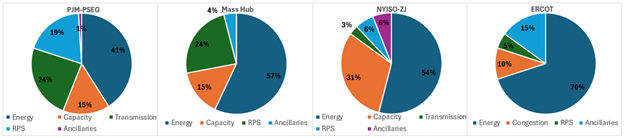

The price of wholesale electricity is the largest and most volatile part of your power bill, however, there are other cost components that are accounting for an increasingly substantial part of the final invoice. Here is a look at the breakout of supply-related electricity cost components (demand-related electricity cost components are a topic for another day) in various parts of the country:

source: various ISO websites

While every utility formulates their electric supply costs differently, the non-energy costs components are growing in terms of cost and complexity. Let’s look at a few examples:

- Capacity – We recently discussed how the most recent capacity auction in PJM is leading to higher electricity costs for end-users beginning in June 2025. Other parts of the country are also preparing for higher capacity costs. While each grid operator has its own method for securing capacity, the overall cost is increasing due to the retirement of fossil fuel power plants and expected load growth. Capacity costs exist to incentivize generators to be available during periods of peak demand. Prices will continue to rise until generation is adequate to meet demand plus a reserve margin. In states like Texas which does not have a capacity market, other ancillary costs are being allocated to ensure reliability (more on that below).

- Renewable Portfolio Standards (RPS) – Also referred to as clean energy standards (CES), these costs are typically established at the state level to meet emission-reduction targets. In general, most of the programs set minimum requirements for the share of electricity from designated energy resources by a specified date. Third-party suppliers must buy electricity from a zero-carbon source or buy qualifying renewable energy credits (RECs) to meet these standards. Many customers are seeing these costs increase over time. In New York for example, the cost of compliance payments for Tier 1 RECs increased from $23.79 per MWh in 2021 to $45.39 per MWh in 2024, a near doubling that gets passed on to customers.

- Ancillary Services – Covers a wide range of functions designed to support proper flow of electricity, correct deviations in frequency, and manage grid uncertainty. In a clean energy future, flexibility (i.e., the ability to tap distributed energy resources when needed) becomes more valuable. The number of intermittent resources tied to the grid is increasing as demand from electrification and economic development continues to expand. Combined with extreme weather, these factors are leading to higher costs of integrating decarbonized solutions. In 2023, ERCOT introduced a new ancillary service called Contingency Reserve Service (ECRS) which added $670 million in new charges to Texas customers during its first six months in operation.

Depending on location, there are dozens of other cost components that make up an electric supply rate. Costs are constantly being amended and added to modernize an aging electric grid. The U.S. has stated the following goals in its vision for the country’s energy future:

- Reduce U.S. greenhouse gas emissions 50-52% below 2005 levels by 2030.

- Reach 100% carbon pollution-free electricity by 2035.

- Achieve a net-zero emissions economy by 2050.

Source: whitehouse.gov

These targets aim to foster a clean energy economy to combat climate change, create jobs, increase resilience, improve health, and achieve energy security. Achieving these objectives will be costly, and the methods used to collect payment will not always be straight forward.

What Does This Mean for Your Business?

It is more important than ever to understand the terms and conditions of your electric supply agreement. Suppliers are regularly updating contract language to keep pace with the rapid changes taking place across the industry. New products are being introduced that can cause confusion for even the most experienced procurement manager.

We went into detail last month about the importance of working with a professional to help achieve budgetary goals. Keeping up to date with the changes occurring in electric markets across the country requires a full-time dedicated effort. It’s crucial to be able to understand which components are included in your supply rate and receive notice from your energy advisor when changes are implemented before it impacts your bottom line.

At Transparent Energy, our team engages in the procurement process at all levels, from regulatory and market intelligence to contract negotiation, legal consultation, and a fully immersive live auction platform. Working with a Transparent Energy expert will offer you a clear picture of the most current and relevant electric supply costs and avoid the pitfalls that accompany a less comprehensive purchasing strategy.

###

If you’d like expert help understanding, monitoring, and managing all of the components that comprise your energy bills, contact Transparent Energy today at letstalk@transparentedge.com.