By Brendan Boyle, Director, Market Intelligence, Transparent Energy, June 2024

Energy is one of those commodities that is a sleeping giant – until it isn’t. That’s typically when geopolitical instability throws off supply and demand (Russia invades Ukraine), the weather turns extremely hot or cold (the “big freeze” in Texas), accidents or natural disasters knock infrastructure offline (Freeport LNG explosion), or some new macro-economic factor alters the entire energy calculus (AI creating a data center boom, and with it high electricity demand).

In each of these cases, being prepared for when the giant wakes is paramount to your success as a business operator (one for whom energy is a major operating expense). At Transparent Energy, one way we like to help clients prepare for the energy future is by stopping first to consider the past. Looking back, what factors have driven energy price changes, and, given these factors, what might the future hold?

So, let’s start there: For 12 consecutive years, beginning in 2009, the average annual price for NYMEX natural gas (an important proxy for electricity prices) settled below $4.50 per MMBtu. Yet, beginning in 2021, several factors emerged to reset expectations for the rest of the decade. Here are three key market drivers we are focused now on as we help clients look ahead to calibrate their energy budgets and evaluate buying opportunities through the end of the decade:

1. Electric demand growth coincides with fossil fuel power plant retirements.

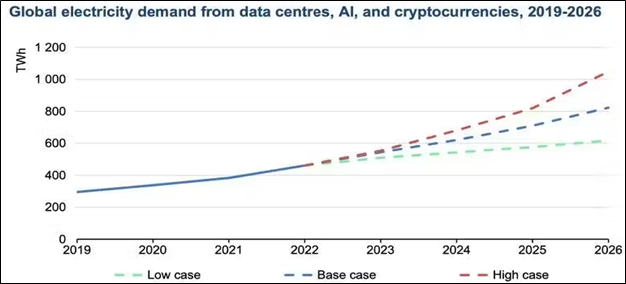

Much has been made of the persistent efforts of local and national governments to decarbonize the economy. The United States and other countries have established numerous benchmarks to reduce harmful emissions, particularly from older fossil fuel power plants. Movement is afoot to electrify the manufacturing, heating, and transportation sectors. Simultaneously we are seeing a spike in electric demand related to data centers and cryptocurrency mining. The Electric Power Research Institute claims that internet queries utilizing artificial intelligence “require around ten times the electricity of traditional searches” and expects U.S. data center electric demand to double by 2030.

Source: International Energy Agency

2. Global thirst for natural gas appears unquenchable.

It wasn’t until 2017 that the U.S. began exporting liquified natural gas (LNG) in a meaningful way, but it took only six years to assume its role as the commodity’s largest shipper to foreign markets. In 2023, U.S. LNG exports set a record just above 15 billion cubic feet (Bcf) with an annual average of 11.9 Bcf/day. U.S. export capacity is expected to increase by more than 80% by 2028, and that forecast could move even higher depending on economics and government regulations.

One element that appears inevitable is the advancement in global demand for LNG. In May of this year, Europe received 42% of American LNG shipments, with Asian markets bringing in another 41%. Latin American and Caribbean nations are also showing stronger demand, which has created even greater competition in the marketplace. Foreign countries are looking to secure long-term supply agreements to ensure adequate energy for years to come. It seems inevitable that LNG exports (along with pipeline gas to Mexico) will put a strain on domestic natural gas reserves for the near future.

3. Weather conditions point to more uncertainty.

According to NOAA, 2023 was the warmest year on record (since 1850), and all 10 of the warmest years occurred during the last decade (2014-2023). Weather is still the primary driver of near-term energy prices. While it is expected that June will start off relatively mild for large portions of the country, meteorologists nearly unanimously forecast another hotter-than-normal summer ahead. This means increased electric power demand and greater depletion of natural gas reserves to fuel power plants.

In addition to higher temperatures, there have been significant climate events that have affected energy prices across the globe, including hurricanes, drought, flooding, and wildfires. Some of these occurrences could be considered common when viewed historically; however, through the lens of climatologists, the frequency, duration, and severity of these disasters is triggering ever-growing concern.

Takeaways

As of June 4th, NYMEX natural gas strip prices out to 2030 are all trading below $4 per MMBtu in contango, where futures prices are trading at a premium to the immediate “spot” price. History has shown that any number of unforeseen events can drive prices substantially higher – i.e., wake the sleeping giant – for a substantial duration (i.e., 2022 averaged $6.64 and 2008 averaged $9.03 per MMBtu across the entire year).

That said, the developments outlined above (along with others) are already factored into current futures pricing. The verdict? The cost to buy natural gas or electricity to cover consumption in 2030 is higher than the cost to buy energy for tomorrow. But the real question we have to ask ourselves is whether that premium is enough? If we flash forward one year from today and look at the price of 2027, 2028, 2029 or 2030 natural gas, do we expect it to be lower than it is trading today? That possibility certainly exists … to an extent.

Right now, we are seeing what happens when natural gas prices get too low: Producers slow down production or cease operations entirely until prices recover. Power plants that can switch from burning coal to natural gas will do so until it is more economically beneficial to shift back to coal.

It is equally likely that one year from now prices will be higher, yet the degree to which prices can increase is dramatically higher than the potential downside that could result by waiting. The same principle holds for electricity. The movement is underway to shut down the oldest, dirtiest generators and replace existing capacity with natural gas and renewables.

The riskiest move right now is to do nothing. It is of the utmost importance to evaluate long-term energy goals and take this opportunity to secure some form of price stability while conditions are still favorable.

###

For help preparing your operations for a new era of natural gas and electricity demand, contact us at letstalk@transparentedge.com