We are currently in a buyer’s market the likes of which has not been seen in the history of deregulated energy – and which we may not witness again in our lifetimes.

A warmer than usual 2019-2020 winter season, followed by the staggering demand destruction of COVID-19, has created a supply and demand imbalance which has left energy producers and suppliers sitting on excess inventory, keeping natural gas and electricity prices at or near historic lows.

Unfortunately, this is all about to change. In fact, it already is.

Energy Prices Rocketing Up

In March of this year, Goldman Sachs warned of an upcoming ‘whiplash’ in natural gas prices by year’s end and into 2021 with natural gas prices rocketing higher. Raymond James echoed these sentiments in a June 2020 report by outlining a scenario where natural gas prices nearly doubled year over year. Transparent Energy’s own market analysis points to a similar conclusion – expectations of a “sharp reversal of natural gas prices towards the end of 2020, carrying into the first quarter of 2021 and beyond.”

Data Analysis Predicting Energy Price Increases

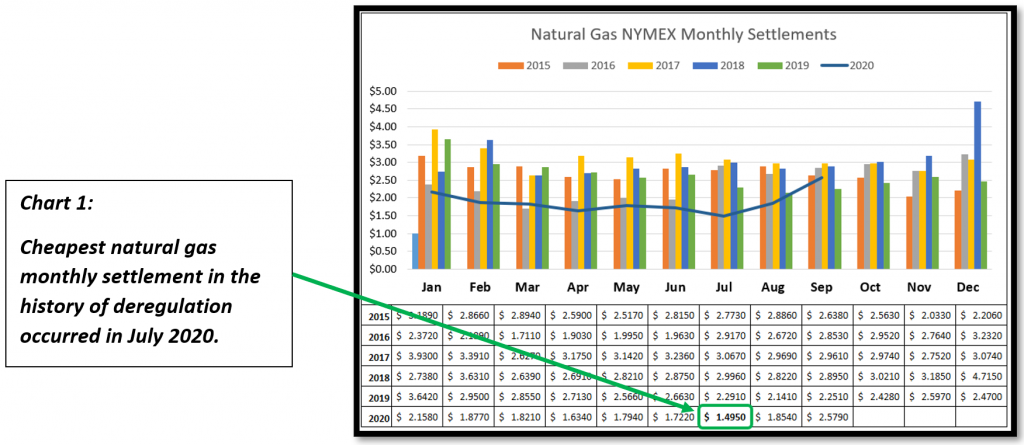

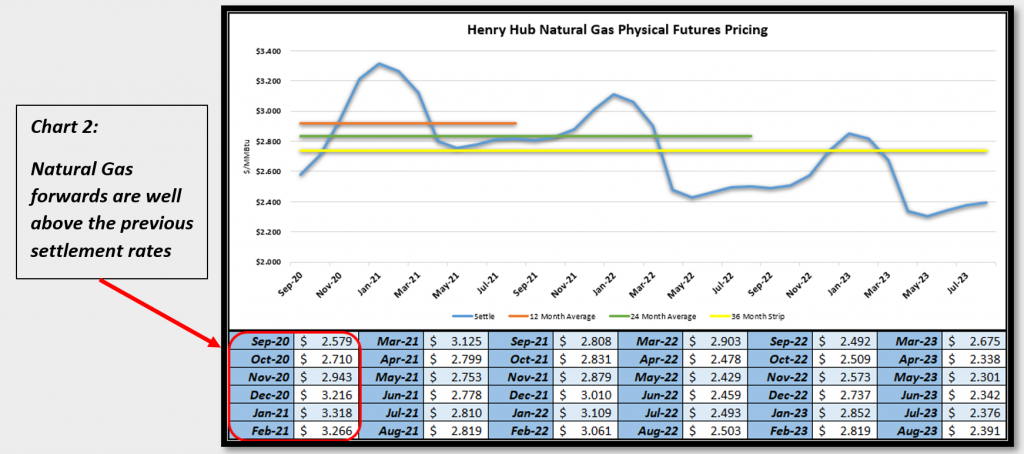

Natural Gas Settlement prices (chart 1) indicate that July 2020 had the cheapest prices for natural gas in the history of deregulation. But look at what happened in August. Prices settled nearly $0.36 higher – a 24% increase in just one month! Further, September is trending even higher, with prices currently at $2.5790 – 43% higher than July settles. Lastly, and most alarming, in chart 2, the natural gas forward/future prices indicate that prices are expected

to settle a full $1.828 higher by December! Was July the bottom of the market?

Prices are expected to rise every month during the fourth quarter of 2020, peaking in the first quarter of 2021. With electricity prices tightly correlated to natural gas prices (remember, more and more electricity now is being generated by natural-gas-burning power plants), the current data points to a potentially shocking future: businesses that do nothing to manage their energy costs today could wake up to energy supply charges 20-50% higher this winter than what can be secured right now in today’s markets.

Due to the pandemic, many businesses are suffering, so a large jump in energy prices could be devastating. Companies and

institutions that wait beyond the third quarter of 2020 to get into a new energy contract will not only lose out on today’s savings, but they also will be faced with paying more for energy than they have in years – a double whammy.

The good news is this all can be avoided. The solution is simple. Consider buying energy now and going long.

The Summer of Energy Procurement is Nearly Over

One habit energy buyers need to kick is waiting until their contract is nearly up before getting back into the market. This is a critical mistake in all times, not just during the COVID-19 pandemic.

When you wait until your energy contract is expiring, you force yourself into taking the price the market offers, good or bad. You dramatically reduce your options and buying power.

Again, the good news is it doesn’t have to be this way. The time to secure your energy supply for the next several years is right now, and that is whether you have 3 months, 6 months, 12 months, or even 24 months remaining on your current contract.

The Summer of Energy Procurement is nearly over. While off their record lows, natural gas and electricity prices today are still very attractive by historical measures, so it is incumbent on you to get your share of these business-friendly rates. Current prices will drive significant bottom-line savings for your business today and over the years of your contract, providing a welcome financial lift during these difficult times.

What’s more, these savings are rooted in a disciplined, analytical approach and an exacting online auction process, which can be secured with zero risk and zero capital expenditures. Financially speaking, this opportunity is about as good as it gets in any market environment.

At Transparent Energy, we’ve been helping commercial, industrial, and nonprofit clients navigate energy market volatility for over a decade. We’ve enabled them to go to market at the most advantageous times and secure the best prices in the market to meet their energy and risk management needs.

Over the course of the last 10 years, we have worked through temporary energy spikes (i.e., the Polar Vortex of 2014) and both favorable and very favorable times of low energy prices. Each time there has been an extremely favorable buying environment, we have rallied around our clients to get them into the market at the right time to secure energy contracts that deliver bottom-line savings to their organization. We have done this through all of 2019 and have continued to do so through 2020 with excellent results.

Throughout this period of very favorable energy prices, clients have opted for longer-term contracts than usual. Not long ago, the average term length for an electricity contract was typically in the 24-36 month range; today we are helping clients secure 36, 48, and even 60-month contracts that deliver savings to their bottom lines each and every one of those months.

As a company that rigorously studies the market and transacts on behalf of its clients on a daily basis, we take energy prices seriously. We are studious so we can act fast on your behalf when needed. We feel strongly, based on the data and what we are helping our customers achieve, that the time to buy is now.

The Summer of Energy Procurement is nearly over, and the message is clear: Consider buying now, going long, and avoid missing out!

###

For help evaluating your current energy contract and opportunity for long-term savings, please contact Jonathan Le, Transparent Energy, at jle@transparentedge.com.

About the Author

Luke McAuliffe is President of Transparent Energy, a leader in online energy procurement. An expert in retail electricity, natural gas, renewables, and demand response sales, and in applying technology and process to extract the best prices from the market, he is an industry veteran with a long record of service excellence. Prior to Transparent Energy, Luke served in senior roles at World Energy Solutions and CPower. He can be contacted at lmcauliffe@transparentedge.com.