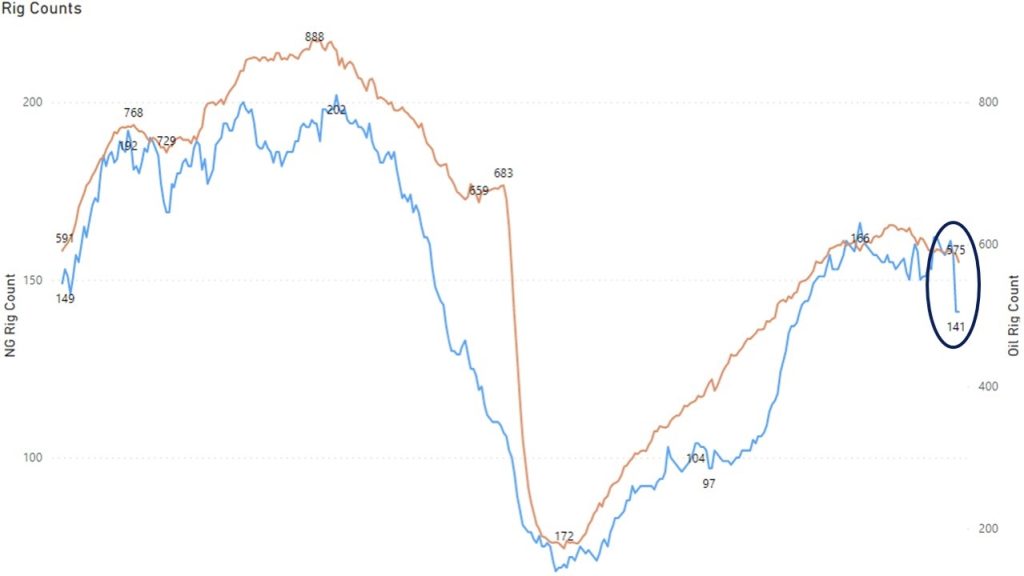

In its Natural Gas Weekly Update for May 17, 2023, the U.S. Energy Information Administration (EIA) noted that earlier this month, “the natural gas rig count decreased by 16 to 141 rigs, the largest week-over-week decline in the natural gas-directed rig count since February 2016.”

This follows a Q1 2023 report from Reuters noting “U.S. energy firms this week cut the number of oil and natural gas rigs, with the quarterly count dropping for the first time since 2020.”

So what gives? And more importantly, what do these rig-count drops mean to you as a buyer of energy (electricity and natural gas) for your business, building portfolio, or institution?

In short, a lot!

What Falling Rig Counts Mean to You

For those of you familiar with our articles at Transparent Energy, you will remember that I have twice pointed to rig-count drops as the single-most visible signal that a potentially massive energy price spike is coming. That’s because when natural gas prices, which are a proxy for electricity prices (since so much electricity is produced by natural-gas burning power plants), fall too low, energy producers find it too expensive to continue drilling.

When that happens, energy companies start turning off production (and because turning natural-gas production on and off is a lot more complicated than turning tap water on and off, bringing natural gas rigs back online can take months).

What we’re really talking about here is supply and demand. Too much natural gas production, combined with a mild winter in 2022 and moderate spring in 2023, has driven prices down precipitously. Energy producers are reacting by reducing production.

Rig-Count Reduction + Hot Summer Weather = Upward Price Pressure

In and of itself, the upward price pressure of reduced natural gas supply could be manageable, but look at the calendar! Summer 2023 is just in front of us, and the last six summers have been the hottest on record, part of a trend that has seen the 10 warmest years on record occurring since 2010.

I’m not a politician or a climatologist; I am an experienced energy advisor and broker. When you couple reduced energy supply with an impending hot summer, natural gas and electricity prices could be poised to spike exponentially.

Remember 2022? After years of record lows, natural gas prices shot up over the course of the year on supply issues, geo-political instability, the LNG export boom, and … you guessed it, a hot summer that saw prices soar to over $9.00/Dth.

For companies that had forgotten energy is a highly volatile commodity, the consequences were disastrous, with some seeing their energy budgets triple, or worse.

Don’t be that company.

The writing is on the wall. Falling rig counts in advance of summer heat are a clear warning signal. Heed it! With natural gas prices still comfortably in the $3s/Dth, now is the time to get into your next long-term electricity and/or natural gas contract, even if you have 12-18 months left on your current contract. You’ll not only be “beating the heat,” you’ll be beating the spike, which will make you look and feel great for years to come.