Back in August, natural gas prices had crested the $9.00/MMBtu mark. Today, as this article goes to press, natural gas futures are pricing in the $5s.

What?!

Yes, you did read that correctly. These prices represent three-month lows, and they also demonstrate in a very visceral way what we mean when we talk about the extreme volatility that characterizes today’s energy markets. Today’s natural gas futures constitute a 30-40% dip in just a short month or two.

So what’s going on? And more importantly, what should you do about it?

Why Natural Gas Prices Have Fallen

Energy markets today are as complex as we’ve ever seen them, with many mega-factors playing a role in pricing.

One is weather. Weather is always a factor in pricing. Natural gas prices have fallen precipitously lately in part because the weather has been so good. Ever since the hot summer, and the increased cooling demand that brings (which drives energy prices higher), the weather has been mild. October behaved like … October. It’s a “shoulder month,” a time between the extremes of hot summer weather and cold winter weather, so energy demand is down.

Correspondingly, production is up – way up. Natural gas injections are making a huge dent in historically low inventories, and that’s a good thing for natural gas prices, and, by extension, electricity prices. Supply, driven by investment in production is up; demand, driven by moderate Fall temperatures, is down. Classic supply and demand, and a victory for short-term pricing.

But don’t get fooled. A market that can drop 40% in a month or two can go up just as fast or more, and that would spell major problems for any large energy buyer’s budget. Overall, while we welcome the current price relief, and are busy helping our clients take advantage of it, we’re remaining vigilant. Here’s why.

Bulls on Parade

Understanding energy markets – and making buying decisions based on that understanding – is not a matter of crystal balls and tea leaves. It requires looking at the facts. The facts supporting the case for high, long-term natural gas and electricity prices – and let me remind you here that while today’s prices are down from August 2022, they are up significantly from last year (see EIA’s most recent Short-Term Energy Outlook) which forecasts “wholesale electricity prices 20-60% higher on average this winter”) – is pretty compelling.

Here’s an overview of the main drivers we are watching that threaten to push natural gas and electricity prices higher:

- Global Realignment of Energy Markets. We’ve said it before, but with the Russian invasion of Ukraine, the EU is in the midst of a massive shift away from reliance on Russian natural gas, and the U.S. is stepping up to fill that need and be that provider. Remember that increase in natural gas inventories I mentioned earlier? It’s ALL going to be accounted for!

- Electrification. EV sales are on the rise, and with billions of dollars being invested in electrical charging stations, thanks in no small part to the Inflation Reduction Act, it’s not hard to see an EV future, and with it massive increases in electricity demand, coming soon.

- Coal-plant retirements. In the old days, when natural gas prices crested the $3.00 mark, many utilities switched their coal-burning electric plants back on. That’s not the case anymore, and coal-plant retirements are continuing unabated. Natural gas is the fuel of choice for electricity generation, and that won’t be changing anytime soon.

- Natural Gas as “Bridge Fuel.” As the cleanest-burning fossil fuel, natural gas has always played a prominent role in the thinking behind the clean-energy transition. It’s just that none of that thinking involved natural gas prices this high….

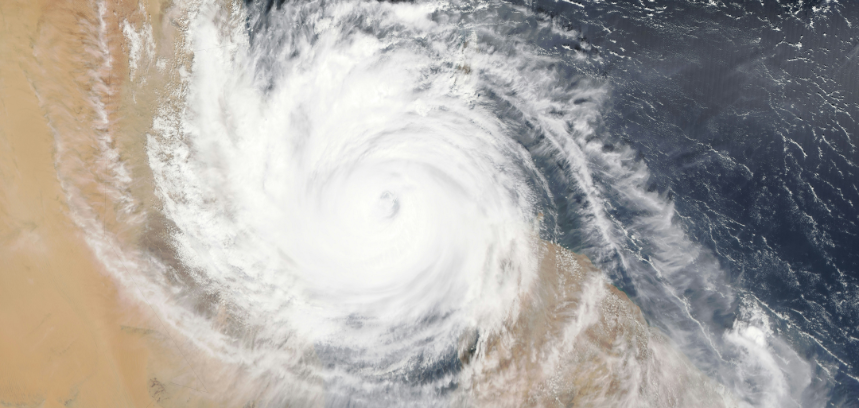

- Weather. I mentioned it before, and while mild temperatures in September and October were really good for energy prices, weather is a double-edged sword. With global demand for natural gas remaining insatiable, a cold winter or an extreme cold-weather event (think a Polar Vortex or Deep Freeze) here or abroad could massively tip the pricing scales.

So where does that leave energy buyers like you who want to keep their operations going today and in the future without breaking the bank? We suggest returning to the fundamentals – not of market prediction, but of energy procurement (something Transparent Energy knows better than anyone):

- Be Proactive. Get ready now, so you can take advantage of soft spots in the market, like the one we are in now. This will be even more important this winter and throughout 2023 as the potential for spikes in energy prices, driven by everything from severe winter weather to geo-political unrest, remains high. Transparent Energy can work with you today to assess your energy use, understand your cost parameters and risk-management needs, and monitor the market daily for an opportunity to pounce on savings. Don’t be an “order taker,” someone who goes to market at the last minute and takes whatever you get because your energy contract is about to run out. That approach could prove tragic. Instead, look ahead and engage an expert like Transparent Energy who can bring the best of the market to you each and every time.

- Budget for Higher Costs. Budget for increased energy costs for 2023 and beyond as energy prices are expected to continue to increase due to permanent demand for U.S. natural gas.

- Develop a Risk-Management Strategy. Understand your short- and long-term pricing options. Have a plan in place to continue to manage away from risk to stay in line with budgets.

- Know Your Options. Letting Transparent Energy bring your load to market and having suppliers bid for it – against each other – in a live auction is the best way for you to price the market, understand all its possibilities, and see and select the best products for your budget and risk tolerance (Hint: your best bet might not be a fixed-price product). Price discovery of this sort exists nowhere else in the market and is absolutely priceless, but don’t take our word for it, see what it meant to a fellow large energy buyer. Consider all your options, so you can make an informed procurement decision.

- Ensure You Leave an Audit Trail to Support Your Decisions. It is vital that you implement a process that shows why energy prices are higher today than during your last procurement and the steps you took to mitigate those price increases as the responsible party. Make informed decisions with facts on hand.

- Engage Your Next Procurement Options with Historical Context. Look at today’s energy rates versus the average of your last five energy contracts to get an idea of the true price increase you are facing, as opposed to looking at your last agreement, which likely represents the cheapest rates in the history of deregulation.

Energy prices whip-sawing back and forth are hardly the image you want to have heading into winter. Working with an expert will help. Working with an expert now will help even more. Transparent Energy is that expert. Need proof? Join us for our webinar, Energy Market Volatility and Strategies to Manage Risk This Winter on November 15 at 2:00 p.m. EDT exploring the current pricing environment and your next steps within it.