By Brendan Boyle, Director, Market Intelligence, Transparent Energy, January 2025

A lot goes into advising clients about their energy buys, including timing, terms, and hedging strategies. At Transparent Energy, we rely on the data: looking at the state of the market, the client’s risk profile, and budgetary goals. One chart that is a mainstay of our process is the NYMEX natural gas forward price curve. This shows us where gas prices are trading and includes three simple lines showing the average cost of a 12, 36, or 60-month contract. To begin, let’s go back in time a bit.

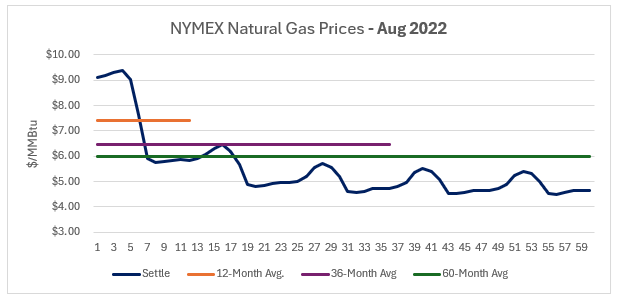

Figure 1 below shows a snapshot of the forward price curve from August 2022:

Figure 1

Back then, the market was backwardated, meaning that near-term prices were more expensive than longer terms, and market prices were substantially higher following Russia’s invasion of Ukraine and U.S. gas inventories falling to 3-year lows.

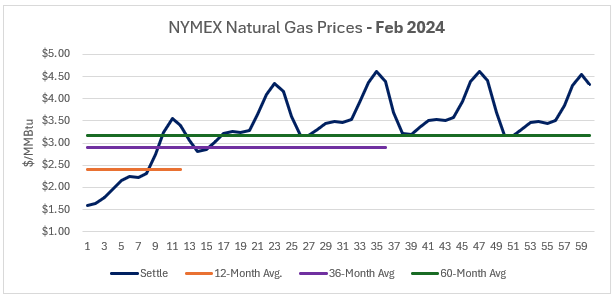

By January 2023, the market had stabilized and the backwardated market flipped to a contango state, where near-term prices were now less expensive than forward years. This trend continued, reaching its peak contango state in February 2024. Figure 2 below shows how much the market had changed during those 18 months. The first takeaway is that the Y-axis had to be adjusted dramatically to account for the price collapse near the front of the curve. Secondly, the orange line showing the 12-month price strip has moved from the top to the bottom. The cost to buy gas was lower for a short-term deal, which is the opposite of Figure 1.

Figure 2

Prices bottomed out shortly thereafter, when the April 2024 natural gas contract settled at $1.575 per MMBtu, the lowest settlement price since the peak of the Covid-19 pandemic in July 2020. The price drop happened due largely to record U.S. natural gas production and a second consecutive warm winter. Gas inventories reached an 8-year high later in the year.

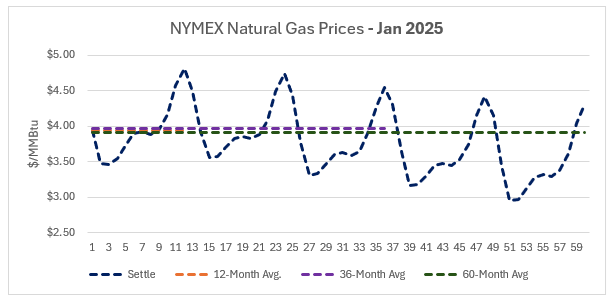

Fast forward to today, and a different picture appears once again:

Figure 3

Figure 3 above shows another change in scale, as prices have recovered. Major drilling companies cut back on production in an effort to send prices higher – and it worked! Combined with record-setting LNG exports, gas prices moved higher across Q4 2024, and yet another trend emerged. The spread between near-term and longer-term natural gas contracts tightened to almost zero – we can barely even see the orange 12-month line in Figure 3 even after converting to dotted lines on the chart. As of close of business on January 24th,the forward calendar strips were trading as follows:

| Balance ‘25 | Calendar ‘26 | Calendar ‘27 | Calendar ‘28 | Calendar ‘29 | Calendar ‘30 |

| $3.910 | $4.079 | $3.910 | $3.781 | $3.615 | $3.520 |

Current conditions are stuck between backwardation and contango as market prices are higher for 2026 and then fall off gradually out to 2030 and beyond.

What Does Transparent Energy Recommend Now?

We spent most of the past year informing clients of price risk, cautioning about winter weather, advising them to BUY NOW, and highlighting success stories from clients who benefited by following our advice. If you have not worked with a Transparent Energy advisor in the past, or if you missed out on our past recommendations, we urge you to follow through with our latest guidance.

The charts above highlight that energy markets are in a constant state of flux. We share these reports to keep you informed of these changes so that you can make informed purchasing decisions. Even if you feel that prices will come down in the future, or if you are uncomfortable locking in your rate for a long term, we recommend that you act now and DO SOMETHING to protect your business for years to come. What does that mean?

With prices below $4 per MMBtu, you can hedge a portion of future electricity and natural gas costs right now to cover a percentage of consumption for the rest of the decade. Many forward-thinking clients will start out with a 25% hedge on a long-term agreement; however, the exact percentage can be adjusted. This acts as a partial stop-loss if prices move higher (and we think that they will). At any time before or during the term of your agreement, additional percentages can be layered in as opportunities arise in the marketplace.

We’ve demonstrated how drastically energy markets have changed over the past 30 months. Looking ahead that far can be dizzying, but you are in a position right now to secure long-term costs at very reasonable rates. Natural gas producers have already exerted their influence on market prices and demonstrated that they will only allow prices to move so low.

A recent survey from the Kansas City Federal Reserve Bank found that natural gas firms require an average price of $3.69 per MMBtu to remain profitable, and above $4.66 per MMBtu to increase drilling substantially. The takeaway here is that prices likely won’t fall much lower than they are currently trading, and that securing a part or all of your future energy expenditure should be an urgent priority.

Recommendations:

- Procure part of, or all of, your load now, depending on your budgetary and risk management goals. You will set your business up for success in the future. We can help.

- The charts and commentary above highlight part of the value working with an expert energy advisory team provides. When you team with Transparent Energy, you get a partner who is analyzing energy markets every day on your behalf and proactively making suggestions like the ones in this article.

- There is more to procuring energy than identifying buying opportunities and market trends. Executing the buy in a way that extracts the best available price from the market is key to your success. Transparent Energy’s proprietary, auction-based procurement process maximizes competition for your business and forces energy supplier to bid down their prices (and margins) to win your contract. If you haven’t purchased energy this way, you are missing out.

Simply put, large energy buyers need both expert market intelligence AND the best way to act on it. At Transparent Energy, we deliver both in every client engagement.

###

If you’d like the kind of market intelligence and expert interpretation featured in this article as part of your company’s everyday experience managing energy – and the ability to procure energy in a way that puts you in the driver’s seat – contact us today atLetsTalk@TransparentEdge.com.